The American (Lottery) Dream: What To Do Should Your Lucky Numbers Hit The Jackpot!

Lucky You, you won the lotto!! Now What?!

Table Of Contents (Jump Links…)

This is a guest post by Olaf The Milie High Finance Guy: milehighfinanceguy.com

Introduction

If there is anything that encapsulates American culture, it is the fact that nearly everyone has the aspirational dream of winning the lottery. While I am not a fan of gambling, I have pondered the thought of what it would feel like to win the Mega Millions or Powerball.

After all, what would you do if you woke up and suddenly had an extra $50 to $100+ million in the bank? You could build your dream house, grant charities life-changing sums, and more. The possibilities are limitless.

Nonetheless, the reality for lottery winners is not as glamorous as the media depicts; they are more likely to declare bankruptcy than their non-winning brethren. Ouch!

Thus, this reality begs the question: What should you do if you win the lottery to ensure you stay financially solvent? Well, let's get this raffle of ideas started!

But first, a qualifier. After all, why should you listen to me? I am a financial advisor (speaking of which, this post does not constitute advice) and blogger who helps people plan for their future. Further, I have received an unexpected six-figure payday before, so I speak from experience on how to utilize such funds.

Euphoria sets in

Winning the lottery or receiving an unexpectedly large sum of money is euphoric. I know this firsthand from receiving a $100k+ insurance settlement a few years back.

At first, I was star-struck when I received the check in the mail. I had never before (or since) received such a large payment directed to myself.

Therefore, my first suggestion to lottery winners is to do nothing for at least a few days. Well, other than reporting that you are the winner. But even that can wait for 24 hours.

When claiming the reward, you can do so anonymously in some states and countries, while in others, you cannot. If you have the opportunity to claim the prize monies without revealing your identity, absolutely do so to avoid being inundated by calls and requests for money.

Then, once you have taken 24 hours to calm down and identify yourself as the winner, you face an important task: deciding how to receive your winnings.

To take the truckload of money now or wait?

Lump sum or annuity?

While each lottery is different, most ask the winner to determine if they want to receive their winnings as an annuity or one-time payment. Annuities operate by paying out over a fixed duration compared to all at once with lump sums.

For the PowerBall and Mega Millions, the annuity options pay out in annual installments for 29 years, increasing with time. If the winner dies prematurely, the remaining payments go to their estate.

Those who take the lump sum receive a reduced payment rather than the total face value of the winning ticket; this is because the lottery board pays out the present value of all the lottery collections, not the future "quoted" value 29 years later. Annoying, is it not?

Anyhow, with both lotteries, you have 60 days to select how you want to receive your winnings. If you can be diligent with the funds, it will likely make the most sense for your cents to take the lump sum. The reasoning is that the annuity payments increase in size over time, which works against the recipient, assuming they invest a good chunk of the winnings in index funds.

Still, financial discipline and solvency are legitimate concerns, especially for lottery winners, given their increased potential for bankruptcy. Thus, if you have struggled to make the best financial decisions in the past due to bankruptcy or massive personal debt, you should likely take the annuity payment if you are not 100% certain you will make better ones in the future.

While this may seem harsh, evaluating your past and present financial habits is essential before determining the final payout decision. So, please do not take any decision lightly and make a realistic assessment, not an aspirational one. And remember, you likely have at least 60 days to decide, depending on the lottery.

A note on taxes

If you win a substantial lottery jackpot (over a million dollars per payment), you will most certainly end up in the highest tax bracket. Resultantly, expect to owe taxes equal to roughly half of your earnings, which will be deducted automatically.

As a word to the wise, though, talk to a CPA to ensure you have the proper withholdings chosen when setting up your lump sum or annuity payments.

The money arrives

Once your lump sum or first annuity payment arrives, deposit the check with a reputable financial institution (if you did not establish direct deposit) and leave it in a cash position for a week at least.

Notably, I did not say to hold the money in physical cash. That is ill-advised due to theft and the potential for natural disasters. Also, please do not put the funds immediately into bitcoin or stocks. Any subsequent decisions like those can wait.

Why? Because you are not ready to make any consequential determinations with your endorphins running haywire.

When you receive a large chunk of money for the first time, your emotions will operate on hyperdrive from the excitement that sets in. I know this firsthand from depositing my $100,000+ insurance settlement check. I felt stupefied, excited, saddened, confused, and more, all at once!

So, take the time to digest that your life has changed considerably. Also, I know I have stressed the importance of waiting several times, but that is for a good reason.

Weigh your options

Assess your prior situation (again)

We often rush to conclusions in our culture, and when your life has permanently changed, it requires further reflection and judgment. Remember, very few things in life need instantaneous decision-making, so ponder away!

Once your euphoria has (somewhat) settled, it is time to evaluate how your financial situation was before winning the lottery. While you did this earlier when determining the payout method, it is crucial to do it again.

Are you in debt or struggling to make ends meet? If so, your first step should involve paying off any debts that are holding you back in life. These include credit card bills, student loans, and personal obligations.

The goal during this initial phase is to clean your financial slate so that you start on a fresh footing.

While it is taboo in the personal finance community to pay off low-interest-rate debts, such as mortgages, I suggest lottery winners pay them off since their focus should now entail living outside the concerns of optimizing every last penny.

Lottery winners have made it and don't need to worry about financial hacking and interest rate arbitraging. If you happen to love optimizing systems, feel free to hack the situation to the optimal benefit. Otherwise, take the big win and eliminate all of your debts.

BLP Note: This is good advise right here, if you’ve won the lotto you’re in the top 0.1% your focus should be risk reduction and simplifying finances not optimizing. This is a common pitfall that many lotto winners fall into leading to trouble. Check out my guest post about Why Most Lotto Winners Lose It All over on MileHigh FinanceGuy.com

Investing in your continued well-being (and future)

The following area lottery winners should focus on is their physical and mental well-being.

Do you work a job that doesn't provide you value? Are you living somewhere that causes you undue stress? Well, as a lottery winner, you have the power to change your status quo.

So, ask yourself, "What steps can I take to change my lifestyle to improve my quality of life?"

Naturally, for most people, it will entail leaving their job and possibly moving. However, doing so requires investing in yourself financially and emotionally.

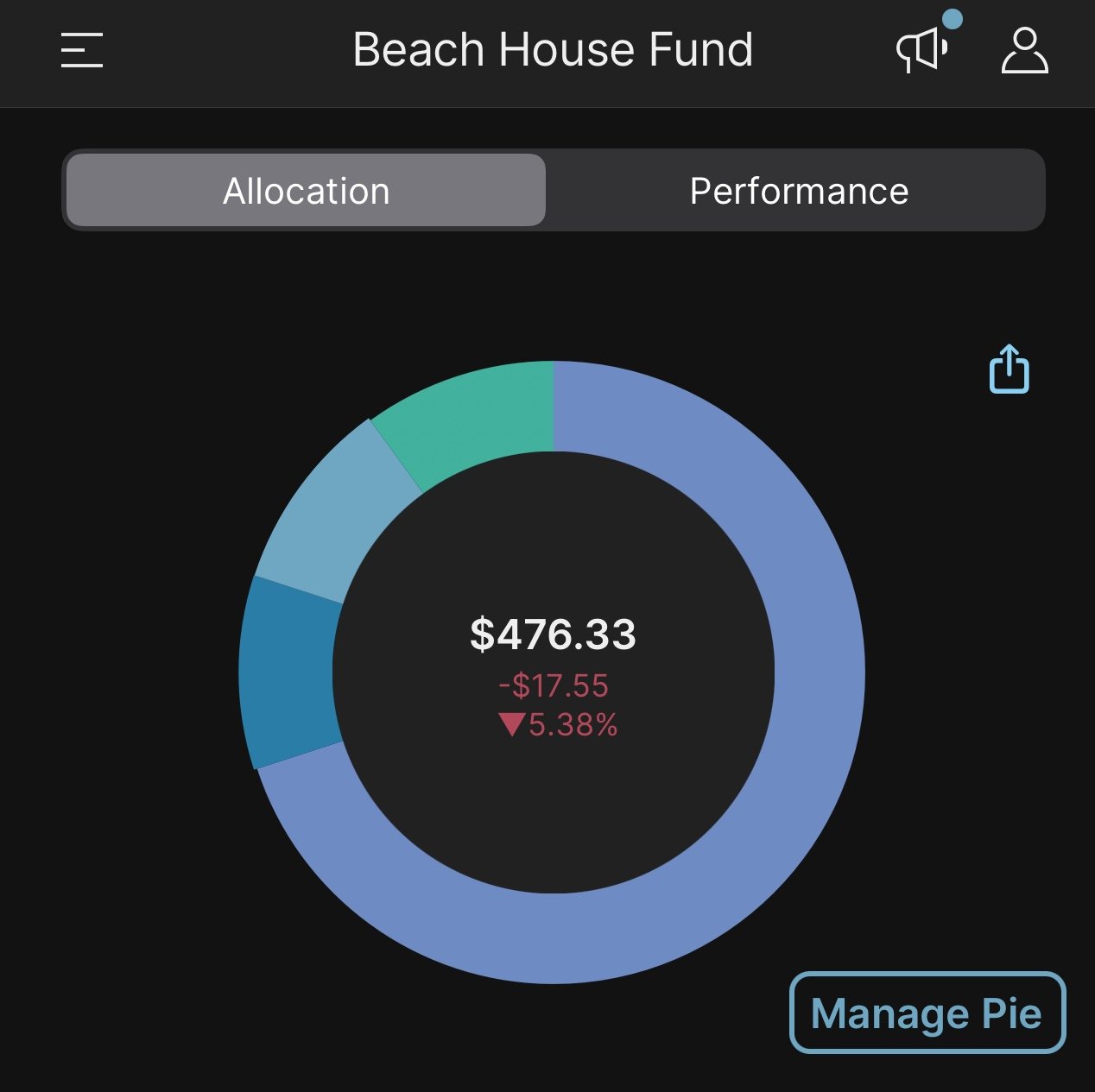

Financially, if you took the lump sum, you must use the remaining funds after paying off your debts and determine how much your new lifestyle will cost versus what you can afford.

As a rule of thumb, take the net proceeds minus the debts paid off, and multiply the remaining amount by 4%. The resulting number is how much you can afford to spend annually, assuming you invest the proceeds. To determine a monthly figure, divide it by 12. I will elaborate further on investing styles shortly.

For those who chose the annuity option, I suggest coming up with an annual budget based on these figures and saving at least 20% of your yearly proceeds as a future nest egg and slush fund to cover large future expenditures as they come up. After all, payments will eventually cease, and younger people will need to have funds saved (and invested) to cover their expenditures.

Once you have invested in yourself financially, you need to invest in your emotional and physical well-being.

If you have had emotional problems, confront them by working with a therapist, you can afford one!

I cannot speak positively enough regarding how much going to therapy helped me. So, put any ego or reservations you have aside! I utilized therapy on two separate occasions when I went through emotionally turbulent times.

For your health, eat better and exercise. You can afford to eat healthy foods, not that ordinary people cannot, and you can afford to focus on getting in better shape. While most people do not need a gym membership or trainer, you can afford those if you fail to get in shape on your own through exercise outside and at home.

Circling back to employment, if you enjoy your job and don't mind working, stay there! A job provides a sense of purpose many people miss after retirement.

BLP Note: Agreed! Feeling connected to your peer group is a very important part of your emotional well being. This is something I’ve struggled with in my retirement and have had to make deliberet steps to find these types of connections.

If you are fortunate enough to have found your calling in life, there is no reason to leave if you are satisfied. However, you could negotiate a better working arrangement since you no longer need income to support yourself. So, don't hesitate to cut back hours or things you don't need. Employers still have less negotiating power than potential employees, so use this change to your advantage!

Lets put this money to work!

How to invest your proceeds

Investing is often considered a daunting process for beginners, so they put it off or hire a pricey advisor when they genuinely don't need one. Yes, there are reasons to hire an advisor, but if you don't have complex needs and are willing to learn the basics of investing, you can go without one.

Those who may want to consider utilizing an investment advisor include those unable to manage money themselves due to health or other personal factors, individuals who wish to invest in complex non-public investments, and those who like the reassurance of having someone help them. However, hiring an advisor does come at a cost, and where possible, I suggest using a fixed-fee advisor.

While some may view my opinion as asinine, I firmly believe that managing $50,000 and $50 million can be done similarly. Those who say otherwise are likely trying to sell you something.

I suggest utilizing index funds, low-cost passive investments that track the market, for the bulk of your money (here is how to choose one). If you want to try and beat the market, try not to allocate more than 10-15% of your holdings to active stock/asset picking or active fund management (which picks stocks/assets for you).

If you want a passive index strategy requiring nearly zero effort, consider utilizing an indexed target date fund where the fund year aligns with the approximate age you will turn 65. The target in target date refers to the year you are targeting for retirement.

If you are already 65 or older, consider choosing a retirement target date fund or one that aligns with the year in which you would have been 65. Younger people can likely take on more risk since they have more time to recoup market downturns, so I suggest choosing a further target date.

For those willing to manage a portfolio, consider building an indexed portfolio using a domestic stock component (like VTI), an international stock component (such as VXUS), and a total bond market fund (like VNB).

When building a portfolio using a three-fund model, you must determine your risk tolerance. Failure to do so will lead to undue stress and panic during market crashes. Resultantly, I suggest reading my beginner's guide to portfolio construction and risk management titled "What Is Risk? Baby Don't Hurt Me, No More!

.My guide covers various allocations to domestic stocks, international stocks, and bonds for different risk levels, which I hope you will find helpful.

As a rule of thumb, lottery retirees will likely need to choose a portfolio with a minimum of 60% stocks and 40% bonds unless they want to draw less than 4% of their now-invested winnings annually.

Notably, bond investments generate interest taxed as ordinary income. In contrast, stock investment sales and dividends are taxed as long-term capital gains (when positions are held for at least a year before being sold). So, don't forget you will owe taxes annually to the IRS.

I suggest working with a CPA, as you can afford one, and they are worth their weight in gold if you find a reputable one.

Charity

You will likely have more than you ever need when you win the lottery. So, please consider donating money to charitable causes to help make the world a better place. Not only will you get a tax deduction, but you also can make an impact that aligns with your belief system.

Few things in life provide a return on investment that feels as good as donating, especially when you were lucky to receive money in the first place, so donate!

One intriguing way to donate utilizes Donor Advised Funds, which you can read more about on FinancialSamurai.com. These donation vehicles provide substantial tax benefits while allowing you to provide sustained impact to various charities. So, please do not dismiss them if you have the time to learn more.

There will be people who want “their cut”

Beggars

Inevitably, when you win the lottery, you will become a prime target for beggars who want a slice of your winnings.

Family members, friends, and even random folks will approach you for money. While only you can choose who deserves your help, do not overextend yourself.

There is nothing wrong with helping those around you. However, you should not be surprised at the sheer number of people that will now ask you for money or pose potentially incredible investment opportunities for you to consider. Be wise and diligent, and don't hesitate to use the word no.

If someone is not willing to associate with you unless you share your wealth, they are not a worthy person.

Life

Winning the lottery is life-changing, so use your fortune wisely and live your best life.

Generally, just because you can buy anything you want doesn't mean you should. Happiness and money are directly correlated until you earn approximately $75,000 a year. After that amount, you gain only a marginal amount of additional satisfaction. Therefore, buying endless things or experiences will likely become a new normal and provide little further enjoyment.

Instead, consider buying the things in life you want and then using the rest to change the world. Making a positive impact through charitable giving or work, or just spending time with those you love will provide the most significant impact. So, don't get lost in materialism.

Life is far too short to waste swiping a credit card non-stop, so take the opportunity to live a beautiful life unconstrained by money.

Closing thoughts

Winning the lottery is a blessing that carries the potential for a curse. However, by utilizing this guide, I hope that you can live your best life if you happen to win.

Remember first to take the time to digest that you have won. Then, choose the most appropriate payout option and get your finances and life in order.

Have you ever won or received an unexpected sum of money? If so, how did it impact your life, and what would you change in retrospect? Be sure to comment below, and as always, have a great day!

BLP: Great post by Olaf from the MileHighFinanceGuy.com ! make sure to check out his website and author bio below. Also Find my guest post “Why Most Lotto Winners Lose It All” over on his website!

Make sure you Join our Community so you don’t miss out on future updates!