Save Money

(Frugal Living)

You can’t out earn bad spending habits! while I’m a believer in enjoying life I also live by the philosophy “I can afford anything I want, just not everything”. being intentional with your spending is the foundation of any early retirement lifestyle.

Wondering “how much longer is before I can retire?” or “how much you I need to save for retirement?”.

This Retirement Calculator will answer both those questions! Plug in your numbers and it gives you an answer how does it work?

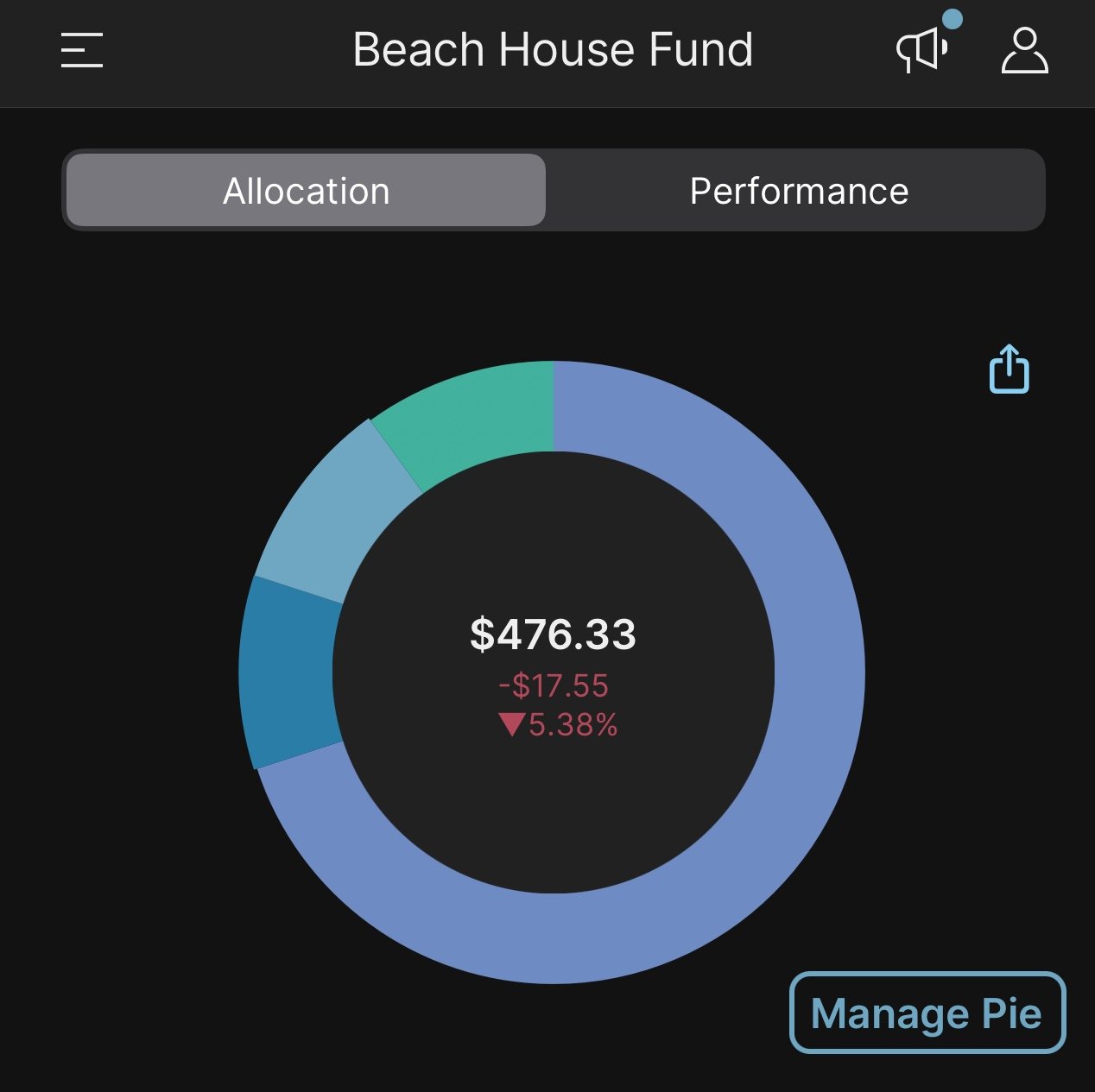

Welcome to the 2nd Monthly update of the Beach House Project (1st full month) Lets take a look at our total progress so far and how the portfolio weathered the rough month of October.

They say making your first $100K is the hardest and once you’ve done it you’re 1/3 the way to a million because the compounding effect of just getting started is huge!!

Welcome to the first Monthly update of the Beach House Project where I walk you thru starting with ZERO and making your first $100K

They say making your first $100K is the hardest and once you’ve done it you’re 1/3 the way to a million because the compounding effect of just getting started is huge!!

I’ve always wanted a beach house! I grew near the water and spend a lot of time on the lake and Pacific Ocean in the summers. One of our good family friends even had a house on the lake with its own beach and boat dock. A lot of great summer memories were spent there. It’s time to get serous and build that dream for myself, and this is how I’m going to do it!

First what the heck is FU money? You’ve heard the term thrown around. Well it’s exactly what it sounds like. Pardon my French here, but the F stands for Fuck and the U stands for You!

So FU Money = Fuck You Money

Basically, FU Money is when you have enough money to not be bound to a toxic work environment or a boss you hate. You have the power to walk away relatively stress free, or if the company unexpectedly laid you off you’d be just fine. In other words, you don’t need that paycheck. At least not for a while.

Let’s talk about consumerism. It sucks. We can all agree on that. Commercialism, greed, and continually trying to keep up with the Jones are all exhausting, destroys our earth, and leaves us feeling just as miserable as ever before. So why do we do it?

While I don’t keep a budget I do check in on my spending every couple months to make sure I’m not overspending. With inflation on the rise and the markets looking a little Shakey I thought the end of the 1stquarter offered a good opportunity to review my spending and share with you guys how much it costs me to live a retired life style.

Everyone is talking about inflation right now and all the damage it can cause. After a close look at my finances and the economy as a whole, I’ve come to a realization. Inflation is necessary and can easily be managed at a personal level to ensure your spending power isn’t eroded.

This is often the most difficult pillar for people to master.

Saving money is a core element of the FIRE movement. By simplifying your lifestyle, you can significantly increase your savings rate. We live in a period of great excess where the average person has an absurd number of luxuries. It’s not as hard as you might think to save a significant portion of your income.

Clutter represents wasted money, things you bought on a whim or impulse, The junk in your garage or attic collecting dust used to be money. Money. You worked hard for and traded your literal time for.