The Blog

My Simple 4-Fund Strategy – A Shift In My Investing Stratagy

One of my all-time favorite quotes is:

“Your rate of return is less important than not getting wiped out”

-Charlie Munger

This is a powerful statement that underscores the value of letting time work for you vs trying to get rich quick. Every time you get wiped out you are reset to $0 (or worse) and the clock is reset for your investment progress.

The real key to successful investing is minimizing your losses. Even a modest rate of return adds up to a significant amount of profit when compounded over a period of time.

“Sell In May & Go Away” The Hard Truth Behind This Old Market Saying!

We’ve all heard the saying “Sell In May & Go Away” but where did it come from? What does it Mean? And most importantly, historically has this been a profitable trading strategy?

The First $100K Is The Hardest: Why is it so important, and how long will it take?

The most important part of your investment journey getting your first $100K invested. It will take you about 1/3rd the time to hit this milestone as reaching the full $1 Million.

Why is this first chunk so difficult? Heres what you can do to speed it up.

Do Markets Do Better In An Election Year? What The Data Says 1871 - 2023

You hear it all the time, people say this will a good year in the markets because it’s an “Election Year” the logic is usually along the lines of one party or another trying to buy votes. But is their actually a correlation? What does the data say

The Stagflation Monster Is Rearing Its Ugly Head: How Do You Fight Back?

As the stock market rages higher setting new all-time highs and inflation measures such as January’s CPI numbers coming in hot market economist are starting to raise the alarm about the return of stagflation.

“Be Fearful When Others Are Greedy” - How The Recession Will Surprise Everyone - A Prediction (2024-2039)

As we head into 2024 the FED will be cutting rates while stock markets are at all time highs. We’ve seen this before & I’m becoming fearful while others are greedy.

Here’s my breakdown of exactly how this recession will play out and how it's probably not what you think.

Retirement Date Calculator: How Much Do I Need to Retire, and How Long Will It Take?

Wondering “how much longer is before I can retire?” or “how much you I need to save for retirement?”.

This Retirement Calculator will answer both those questions! Plug in your numbers and it gives you an answer how does it work?

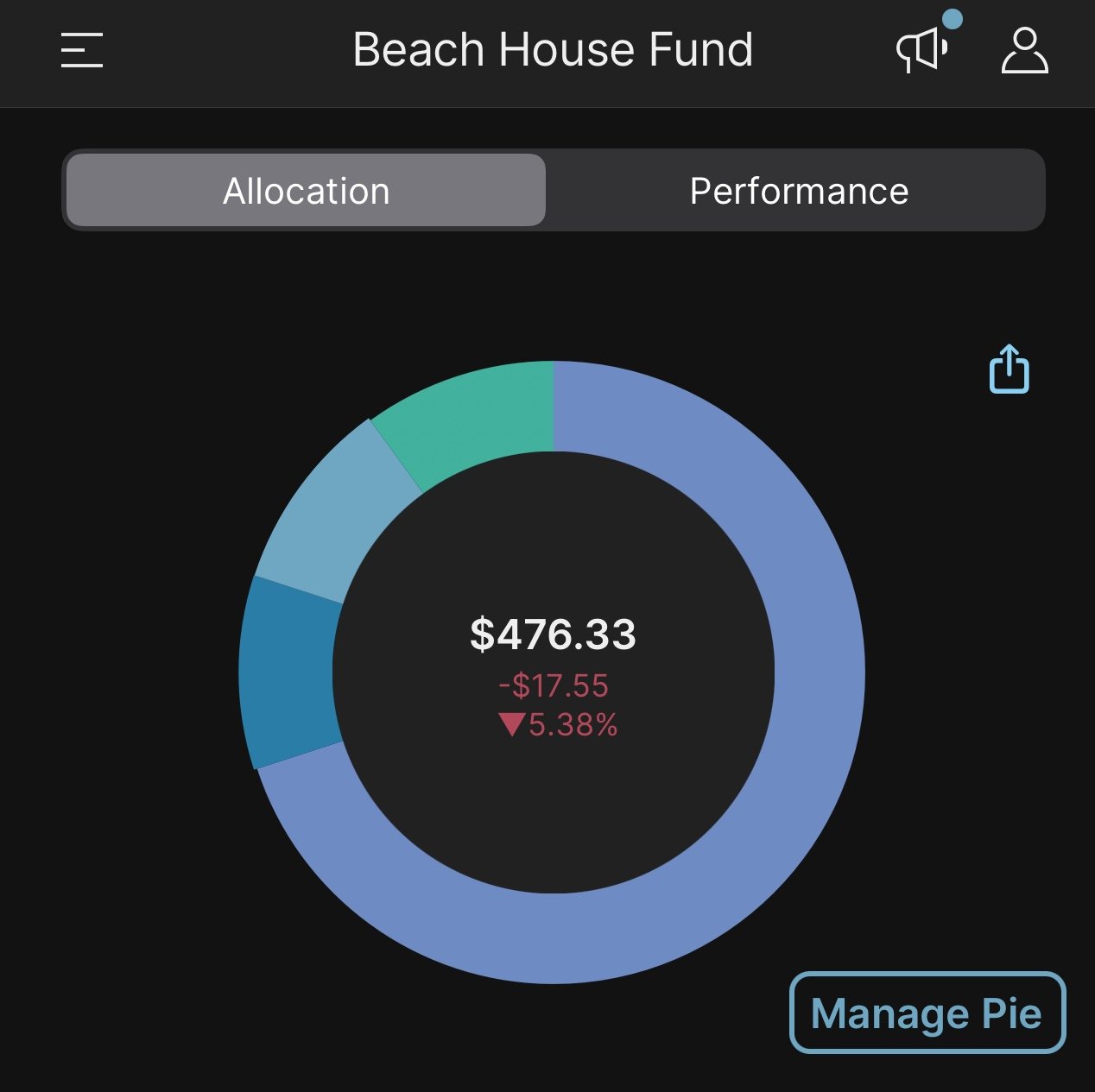

Month 2 Update: Beach House Fund – How To Start Investing And Make Your First $100K!

Welcome to the 2nd Monthly update of the Beach House Project (1st full month) Lets take a look at our total progress so far and how the portfolio weathered the rough month of October.

They say making your first $100K is the hardest and once you’ve done it you’re 1/3 the way to a million because the compounding effect of just getting started is huge!!

Month 1 Update:Beach House Fund – How To Start Investing And Make Your First $100K!

Welcome to the first Monthly update of the Beach House Project where I walk you thru starting with ZERO and making your first $100K

They say making your first $100K is the hardest and once you’ve done it you’re 1/3 the way to a million because the compounding effect of just getting started is huge!!

New Beach House Fund – How To Start Investing And Make Your First $100K!

I’ve always wanted a beach house! I grew near the water and spend a lot of time on the lake and Pacific Ocean in the summers. One of our good family friends even had a house on the lake with its own beach and boat dock. A lot of great summer memories were spent there. It’s time to get serous and build that dream for myself, and this is how I’m going to do it!

Podcast Interview With Dividend Dave!!

Excited to announce my second Podcast interview! We jump on The Passive Income Podcast with Dividend Dave!

A fun over some beers style chat where we talked about retiring early, going blind, and what I’m currently investing in. He also had a fun quick fire section where we talked about REITS, Picking Stocks, Value Traps, and more.

Podcast Interview With Adulting Is Easy!!

Hey Guys!!

I haven’t written an article in a little while but I’ve been busy! Excited to announce my first Podcast interview! Lauren over at Adulting Is Easy asked some really insightful questions and I enjoyed sharing my experience navigating the process of going blind and how I managed to retire Early!

Interview: The Pursuit of Enough - Observations on Real-Estate, Markets, and Life

Today we are doing an interview to get to know the man behind The Pursuit of Enough who is a realtor in Northern Virginia, writes on real-estate, investing, and deeper topics on investments and the “Pursuit of Enough” concept. The real question is what is that “Enough Point” that makes you feel comfortable and fulfilled without having to be a wage slave for the rest of your life.

99 Charlie Munger Quotes: Wise Words Of A Great Investor

Charlie Munger turns 99 January 1st 2023 here are 99 quotes with lessons and take aways. Lets see what lessons we can take away from this increasable Investor!

My Simple 3-Fund Strategy – The perfect strategy to weather all market conditions and not get wiped out.

One of my all-time favorite quotes is:

“Your rate of return is less important than not getting wiped out”

-Charlie Munger

This is a powerful statement that underscores the value of letting time work for you vs trying to get rich quick. Every time you get wiped out you are reset to $0 (or worse) and the clock is reset for your investment progress.

The real key to successful investing is minimizing your losses. Even a modest rate of return adds up to a significant amount of profit when compounded over a period of time.

The American (Lottery) Dream: What To Do Should Your Lucky Numbers Hit The Jackpot!

If there is anything that encapsulates American culture, it is the fact that nearly everyone has the aspirational dream of winning the lottery.

What it would feel like to win the Mega Millions or Powerball.

Here's what to do if your lucky numbers hit!

The Power Of Good Enough: The Difference Between Maximizers & Sufficers.

What makes some people able to make large life-changing decisions in a snap and others agonize over every little detail. I discovered that myself and my friends fall into two very different camps when it comes to making big decisions.

Surviving a Recession Requires More Than Blind Luck: Recession Survival Guide

Five actions needed to build your financial life raft, to ensure your financial survival during the coming recession (or even depression)

The Mile High Recession Survival Guide:

+Build and maintain an emergency fund

+Keep your options open; always network

The Lost Decade: How’d Investors Really Do & What Happens If We Are Headed Into Another Lost Decade

The 2000s had one of the worst bear markets we’ve seen in history. Not once, but twice.Historians now refer to this period in history as the Lost Decade.

With 2022 starting off as one of the worst years for investors in over 50 years. Leading many investors to question could this be another lost decade? If so what can we learn from the 2000's?

Everything You Need To Know About Crypto Currency, NFT’s, Web3.0 and The Future of Blockchain Technology (an Investors Perspective)

Blockchain, Crypto Currency, NFT’s, and Web 3.0 are all the buzz right now, your friends are telling you to invest in it and that it’s the wave of the future! But what are they? What are they worth? Is it a scam? If these are questions you have then you’re in the right place, I’m going to break these topics down so you understand what they are and can then make an informed decision about getting involved or not.