The First $100K Is The Hardest: Why is it so important, and how long will it take?

The first $100K is by far the hardest!

Why is investing the first $100K so important?

“The first $100,000 is a b*ch, but you gotta do it. ”

Just like any journey the most important part of your investment journey is getting started! Once you’ve invested your first $100K you’ve mastered the basics needed to get to $1 Million or more, all you have to do is just keep doing the same thing for a longer period of time. But how long will it take? Are you doing enough to get their in a reasonable amount of time?

It’s really not so different from going for a hike. The first mile is largely the same as mile 10. But you have to figure out where you’re going and get on the correct trail before you can get to that first mile post.

Note I said invested, this doesn’t mean a net worth including your car, your house, and fancy dishes. No this is money that’s been invested into productive assets and is actively working for you to make your richer. This is an important distinction, because a lot of people have $100K worth of “Stuff” but things like cars aren’t productive assets, in fact the more stuff you have the more it generally costs to take care of. We are looking to build our army of hard working little green men. For an example of what a simple yet effective portfolio looks like check out My Simple 3 Fund Portfolio article.

Getting your first $100K put to work in a productive investment portfolio requires that you’ve master several basic skills that rich people have.

1) You’ve gotten out of consumer debt

While this might seem like a simple achievement the Aspen Institute says 10.4% of Americans have a NEGATIVE net worth!! So just getting to ZERO puts you ahead of a sizable chunk of people!

When you carry consumer debt it’s like a boat anchor around your ankles pulling you down as you try to swim. It’s a constant burden.

Some debt is natural when you are younger, such as a mortgage, or student loans, you should work to pay these down over time but they are more manageable than other more toxic forms of debt such as credit card, payday loans, or a new car loan every 5 years because you just have to have a shiny new ride.

2) You live below your means

It’s not just good enough to stay out of debt all that does is get you to zero. If you want to get to the magic $100K you need to prioritize saving and investing part of every paycheck.

A 2023 study by Payroll.org said that 78% of Americans live paycheck to paycheck If you just live paycheck to paycheck you’ll never amass a sizable net worth.

Thankfully this means that by living below your means you are getting ahead of 78% of Americans. Right size your life so your monthly expenditures are less than your regular paycheck.

3) You put that money to work

While you can make it to a $100K portfolio without investing it’s certainly the harder and slower path. And very few people will be able to make it to $1 Million without the assistance of some compounding investment returns to speed things up. As I mentioned earlier a simple portfolio such as My Simple 3 Fund Portfolio is all you really need, you don’t need any risky strategies or get rich quick schemes to make your money work for you.

If you’re new to investing I highly recommend the book The Simple Path To Wealth by JL Collins.

You’ll spend most of your time with less than $250K on your path to $1 Million

1/3rd the way to $1 Million

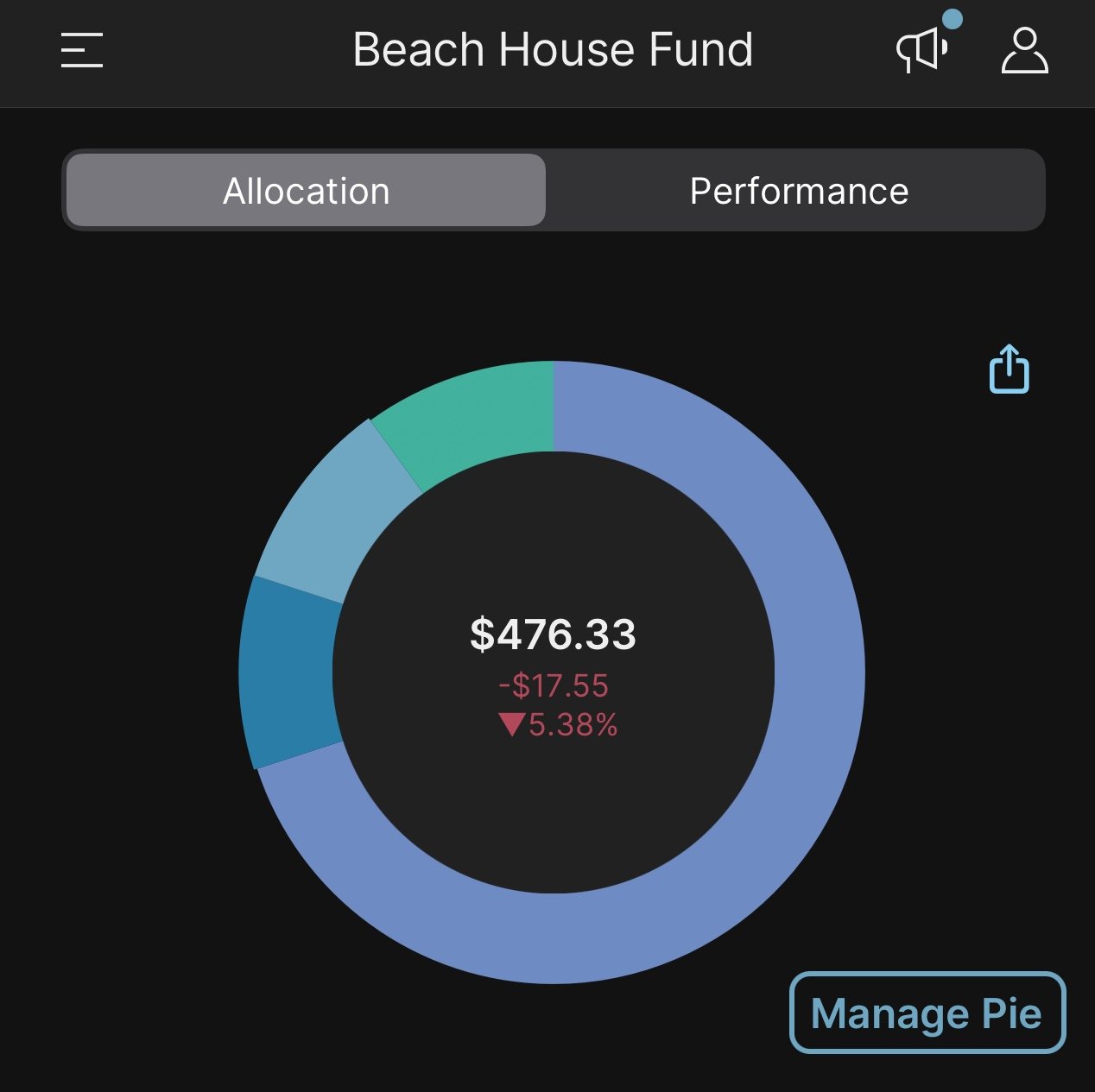

If we assume a modest $500/ month contribution with a yearly return of 8% you go from zero to $1 Million in 33.39 years.

But the first $100K takes 10.62 years or In other words the first 10% of your first $1 Million takes 31.8% of the total time. That’s almost a full 1/3rd!!

This is why they say the first $100K is the hardest, not only do you have to get out of any debt you may have, master the skill of consistently saving and investing, the first $100K is a real grind with little help from the power of compounding interest.

Once you’ve got the first $100K you’ll hit $250K in just 7.77 years. That’s an increase of 150% for just 73% of the time it took to hit your first $100K.

That’s because as you work past the first $100K it’s actively earning money for you to give you a nice tail wind you didn’t have helping before.

Lesson? Get your first $100K ASAP!! You can ease off the gas a bit once you’ve cleared that first milestone if you need to but clearing that first bit is increadably important.

How long will it take you to get to $100K?

So you might be sitting here thinking that sounds great! But how long will this take me? I already have some money saved up, or I’m contributing something different than $500/ month.

Well I made a calculator just for you!

This tool will calculate how long It will take you to reach a given goal with any parameters you choose to use. have a different goal than $100K or you want to invest more or have some money saved already? Great just plug your numbers in!

I’ve set it to $100K as a default amount as that tends to be the first big milestone that most people need to work toward their future goals. .

Let us know in the comments below how much longer it is before you hit your first $100K!!

How Long Will It Take?

Result

| Durration (Months) | |

| Durration (Years) | |

| Date Goal Is Reached |

Portfolio Value Over Time

How far ahead are you if you have $100K, $250K, $500K, $750K?

Now I know this post has been mainly focused on hitting your first $100K but what if you already have $100K or more? How much would you have after that same 33.39 year time period it would take to go from $0-$1 Million?

Well I’m glad you asked.

Starting with a little makes a BIG difference

Starting from a non-zero number makes a bigger difference than you think

As you can see from my pretty chart and table of values the ending NW varies wildly!

Just starting with $100K instead of zero means you will finish with $1.435 million MORE than someone who starts from zero. That’s HUGE! for the same $500/ month over the same time period you more than double your returns, simply by starting with $100K.

If you start with $250K or $500K we are talking orders of magnitude more ($3.590 & 7.180Million more respectively). That’s some pretty serous money.

This is why I say the first $100K is the most important, it’s about the point where the compounding effect of investing really starts to tip significantly in your favor.

Why The Rich Get Richer

When they say the rich get richer it’s not because they lie, cheat, or steal, (well some might) It’s really because they’ve mastered the skills to hit that first $100K I outlined above, and they’ve had enough time to get on the right side of the compounding equation. It’s not a seceret club or special trick. It’s just math.

Now at this point it becomes tempting to see those big numbers and start dreaming about that Lamborghini, or the huge house you’ve always wanted. But remember for every $100K you spend today you are potentially leaving about $1.435 Million on the table in 33 years. I’m not saying you can’t enjoy life once you’ve gotten sufficiently ahead, just recognize the opportunity cost of what a large purchase early in the compounding process will cost you down the road.

NEW Calculator Tools

In addition to the “How Long Will It Take?” tool above I’ve also created the below tool so you can figure out how much you need to contribute every month given a certain starting amount, goal amount, and target completion date.

This is a classic “start with the end in mind” approach. I often find I need to make changes today in order to get to where I want to be tomorrow. That’s OK it’s an important part of building a solid plan.

These calculators can also be found in the Calculators Hub Section of this website where they are always available and 100% Free to everyone.

Contribution Calculator

Result

| Required Monthly Contribution |

Conclusion

Hopefully you’ve found this post useful in better understanding how important reaching the first $100K in a timely manner is to your future net worth. I’ve also provided a few tools to help you analyze your current situation and build a plan to ensure you get there as quickly as possible.

Let me know in the comments how much longer until you reach your first $100K? If you’ve already hit that magic number, whats it going to take to get you to the 7 figure club?

If you haven’t joined the newsletter yet make sure to sign up! we’ll have more of these deep dive articles where we figure out the most optimal way to get rich. I also have more exciting calculator tools coming soon that you won’t want to miss!