Month 17 Update - Beach House Fund – Journey To The First $100K!

Steady Progress!

Table Of Contents

Introduction

Welcome to the January 2025 update of the Blind Luck Beach House Project!!

They say making your first $100K is the hardest because it requires your to change your money habits and build systems to accumulate wealth.

Once you’ve done it you’re 1/3 the way to a million because the compounding effect of just getting started is huge!!

For a detailed write up on why the first $100K is so important plus a some handy calculator tools showing you how long it will take check out this months post How Long Will It Take To Make Your First $100K?

My Goals

When I first set out on this goal in September of 2023 I knew it was going to be a multi year process. I also knew the first year would be the toughest as I worked on getting some momentum going on this so I set some specific and measurable goals.

I outlined this process in my S.M.A.R.T. Goals What They Are & How To Use Them post. You can also find a good example of goal setting in my 2024 New Years Goals update where I write down and break down the details for my top 5 goals for 2024. (Which include this The Beach House Fund of course!)

Now that the first full year has been sucessfully completed let’s take a look at what the goal for 2025 will be.

Goals - High Level

Buy a beach house or have enough invested so I can rent a beach house whenever I want anywhere I want without thinking about money.

Specific Goals (The How):

Have $100,000 Invested for a down payment

Within 5 years (by end of 2028)

Monthly Updates for accountability

Show others how to start from $0 and become financially independent

What I want to do is encourage anyone who has $0 to get started, and make a life changing amount of money

In 2025 the main focus is going to be to save $25,000 by the end of the year.

This is 150% of what my 2024 goal was and is going to be a challenge. But that’s what forces us to stretch ourselves and grow. I’m confident I can get there by the end of the year.

Contribution

In the past month I made the following contributions to the beach house fund: .

January 2025 Contributions:

$150 Regular Income

$52.91 Credit Card Cash Back

$22.74 X Ads Revenue (Formorly Twitter)

$21 M1 Platform Fee Offset*

January Total: $246.65

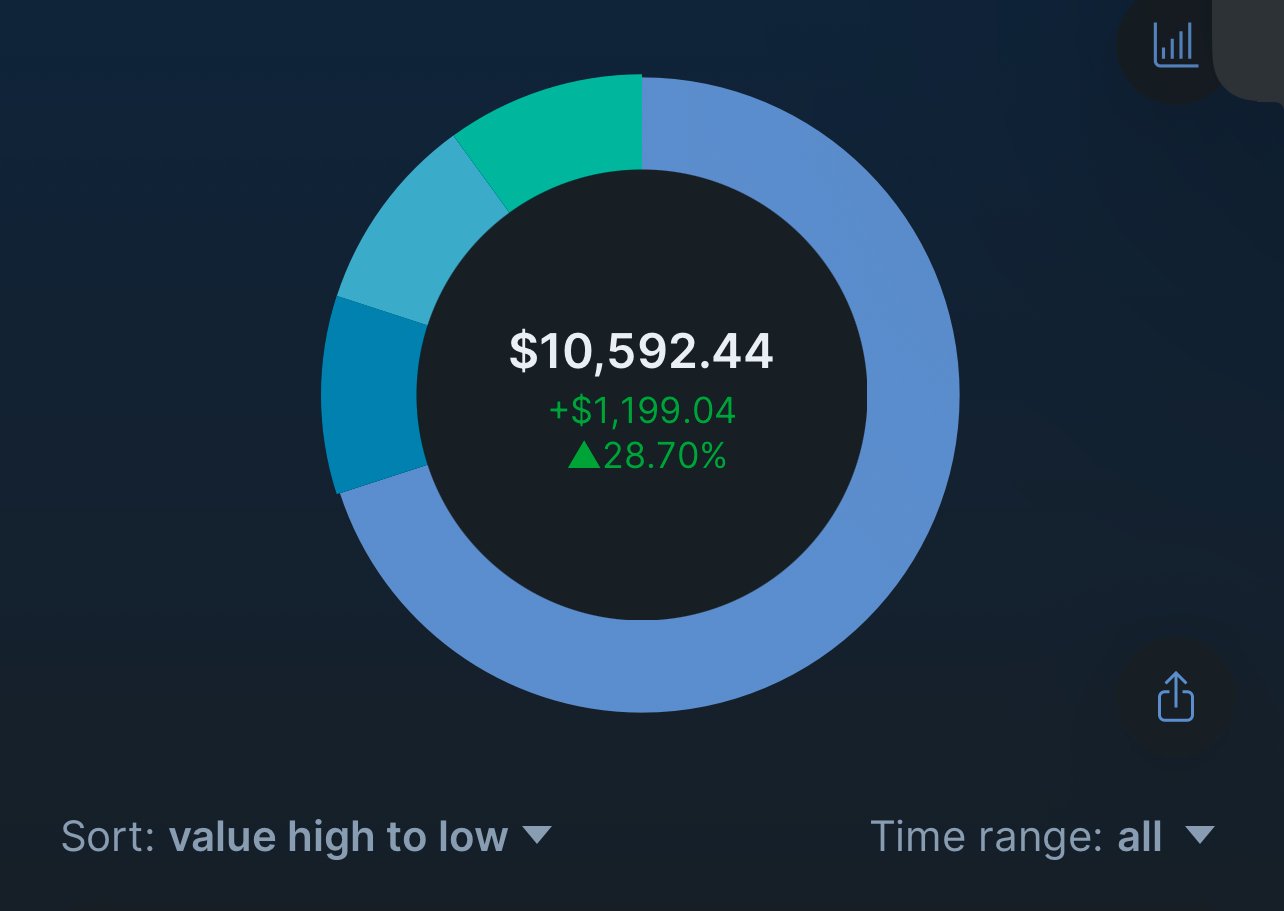

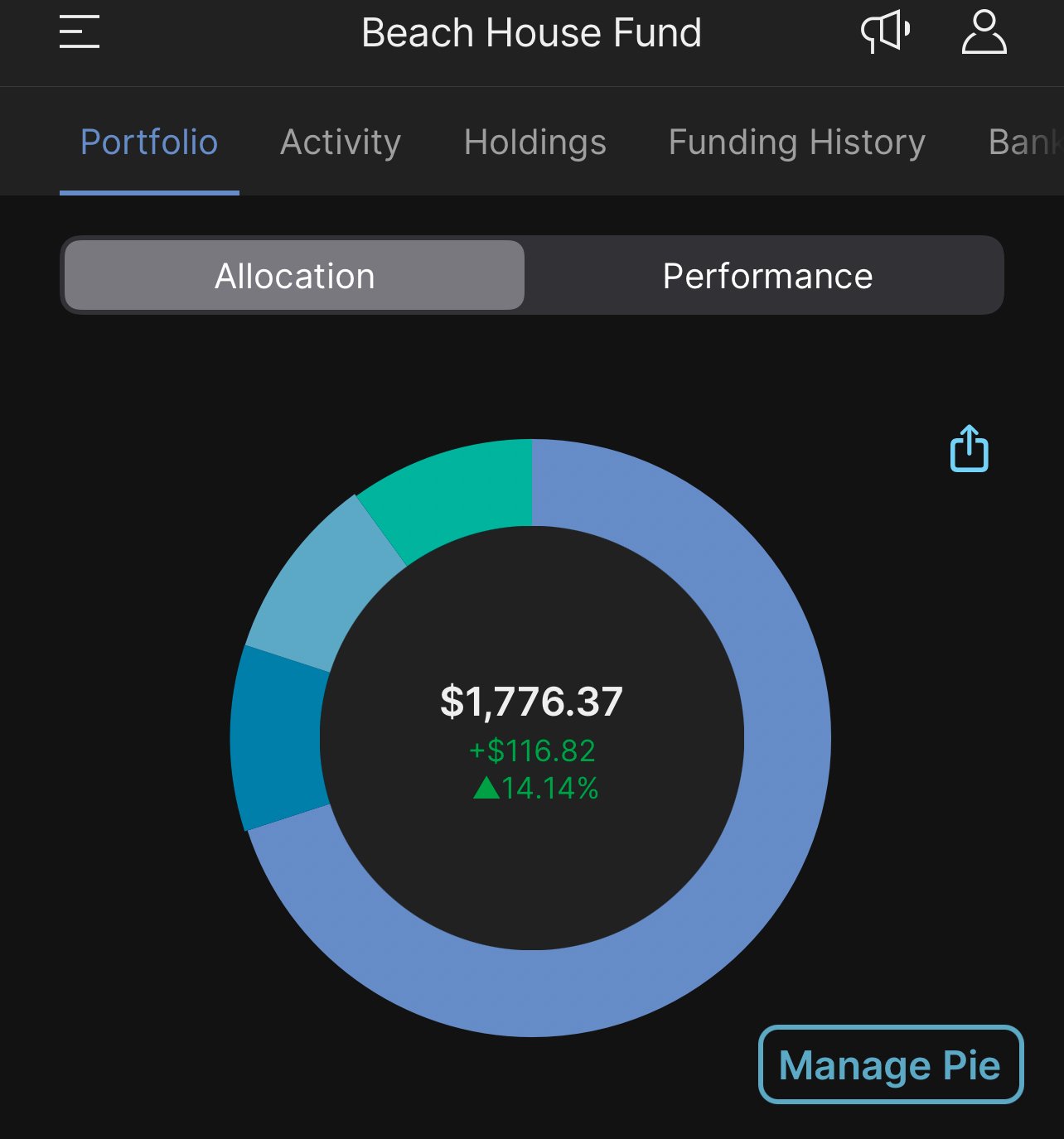

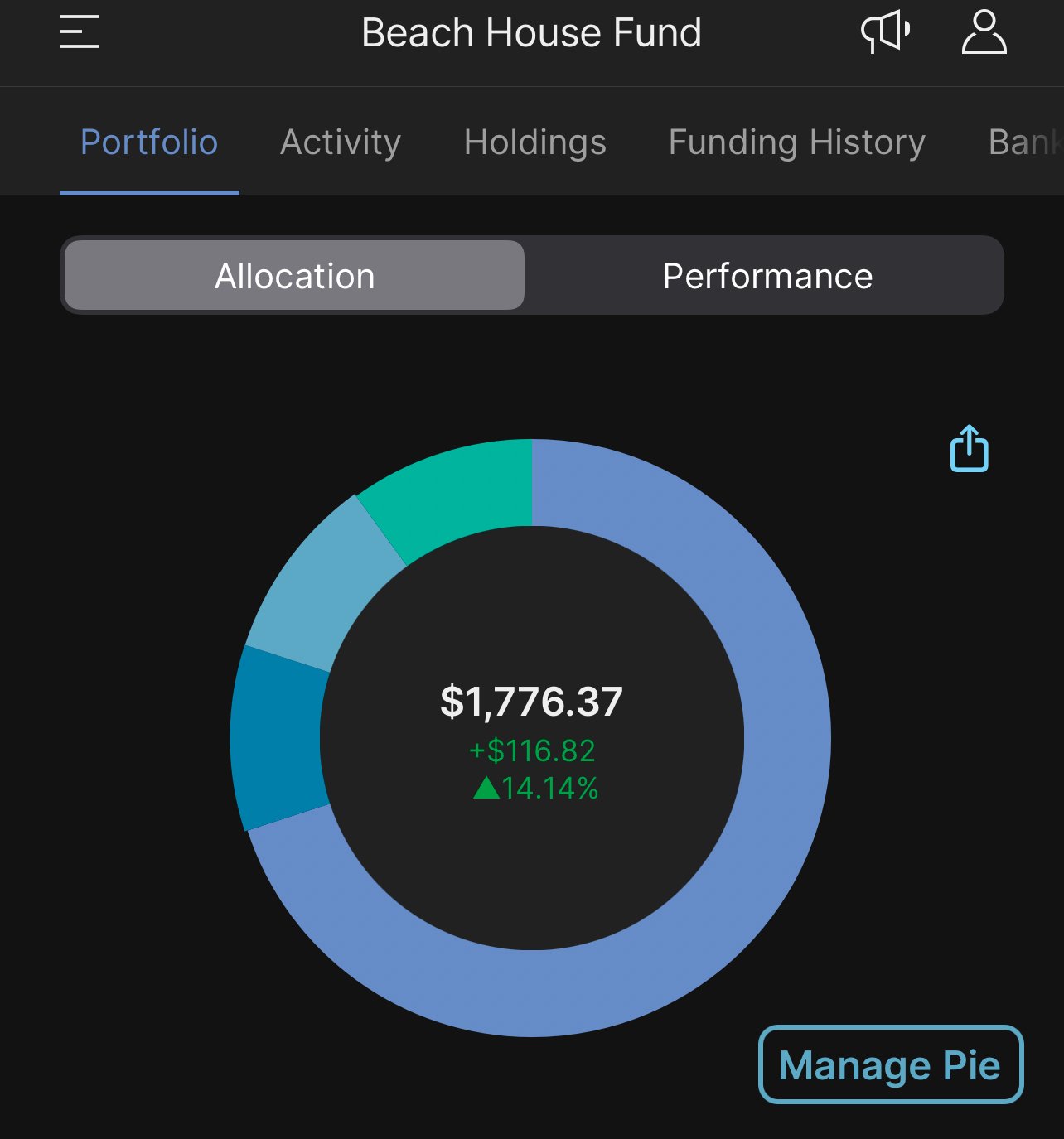

Fund Total: $10,592.44

Total Profits To Date: $1,238.41

** Note now that my account is over $10,000 I no longer get charged an M1 Platform fee. I added $21 to this account to offset the platform fee’s I’ve paid to date. Moving forward there will be no more fee’s as long as I keep this account over $10K which I fully intend to.

January was a light contribution month for me for a couple of reasons

1) I made a large contribution to my ROTH IRA (new year!) I intend to add $7K by the end of 2025

2) Increased my cash position

3) I have some large expenses this month (new fire place, and other home projects) It’s nice in AZ this time of year, time to do some home projects :)

4) Markets were at all time highs and with a new administration coming into the White House I suspect things will be choppy, I’ll try to buy any dips we get in Feb/ March. I don’t advocate trying to time the market (note I sold nothing) but given some of my other goals it seemed like a good time to stack some cash.

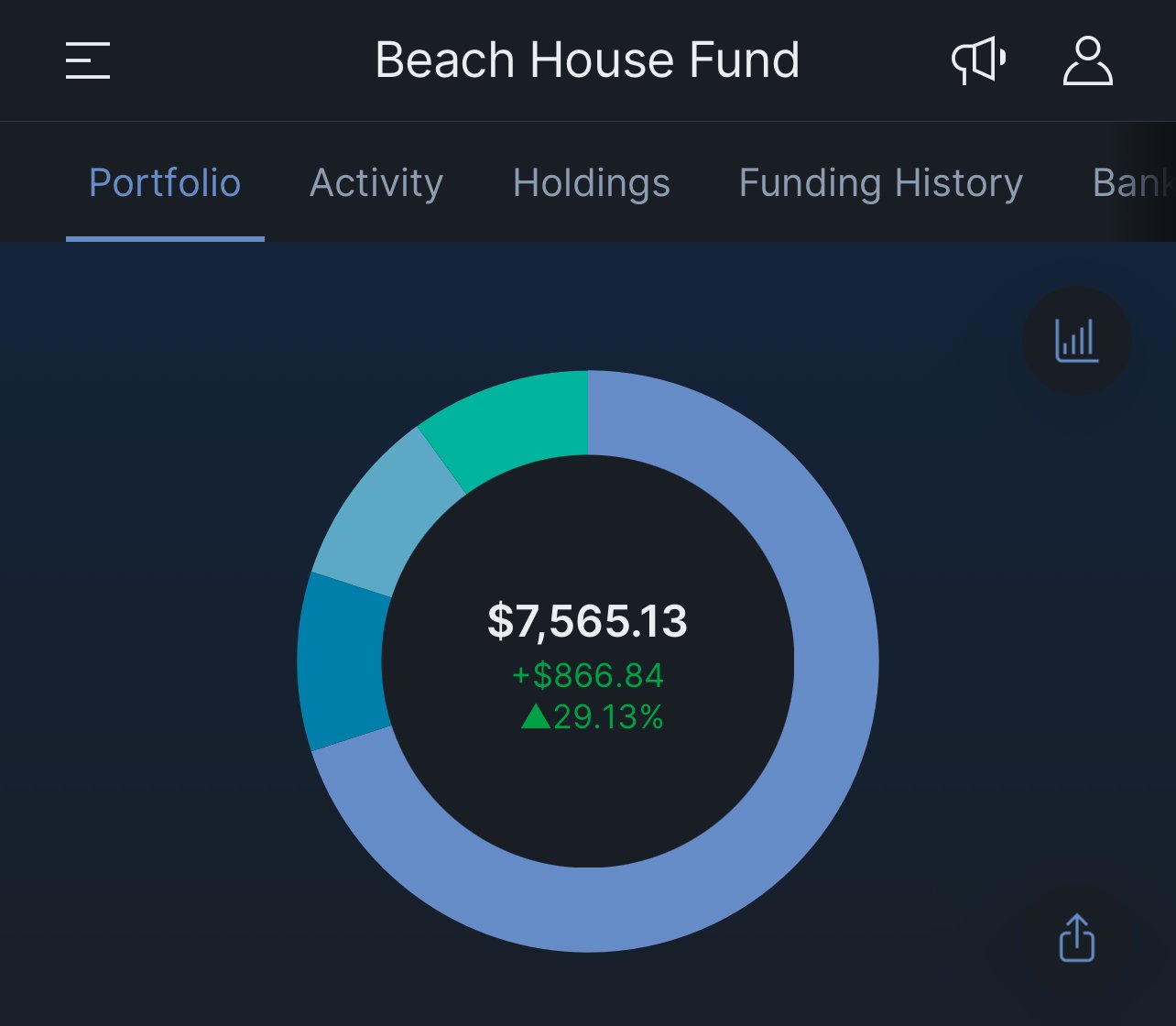

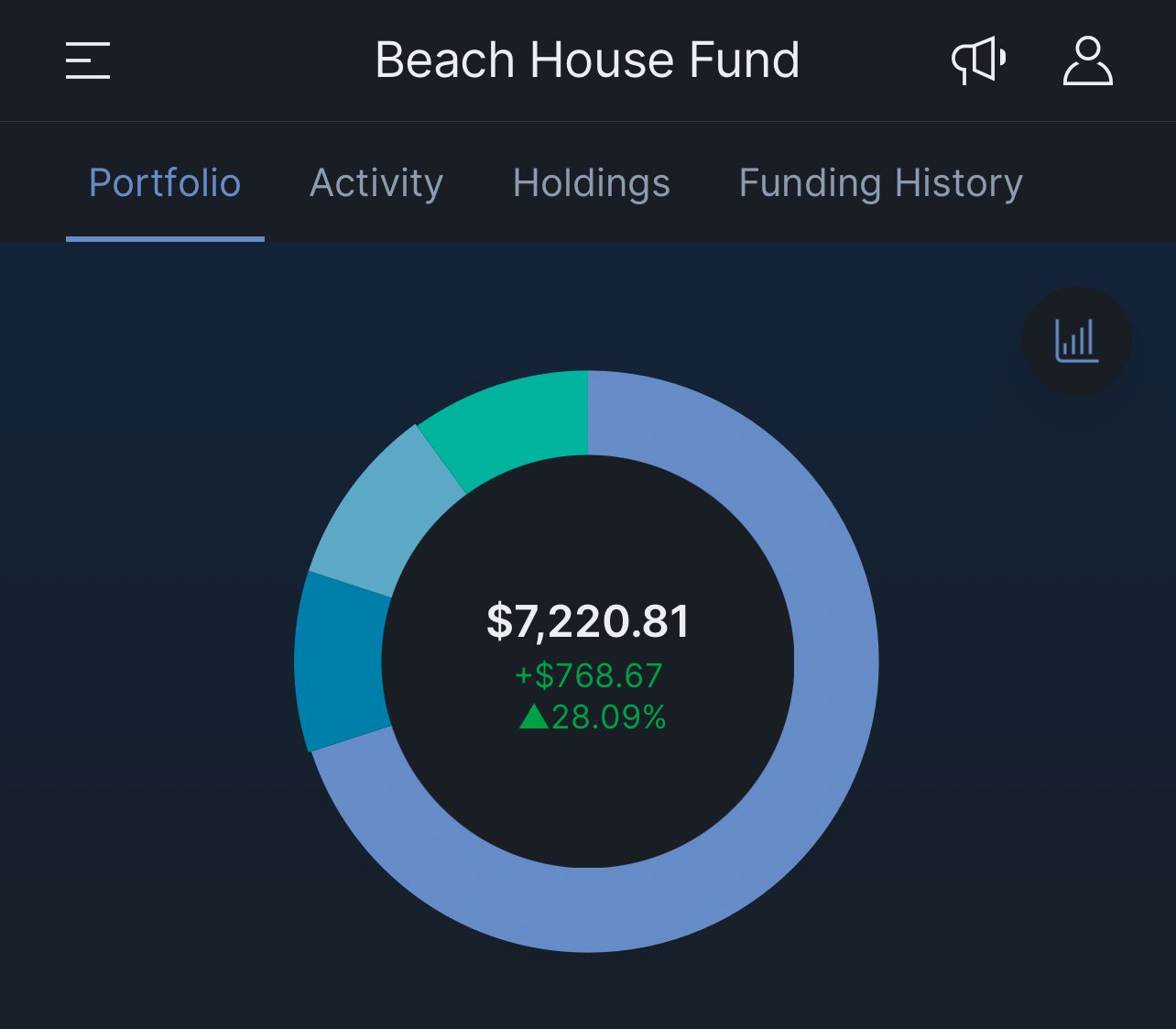

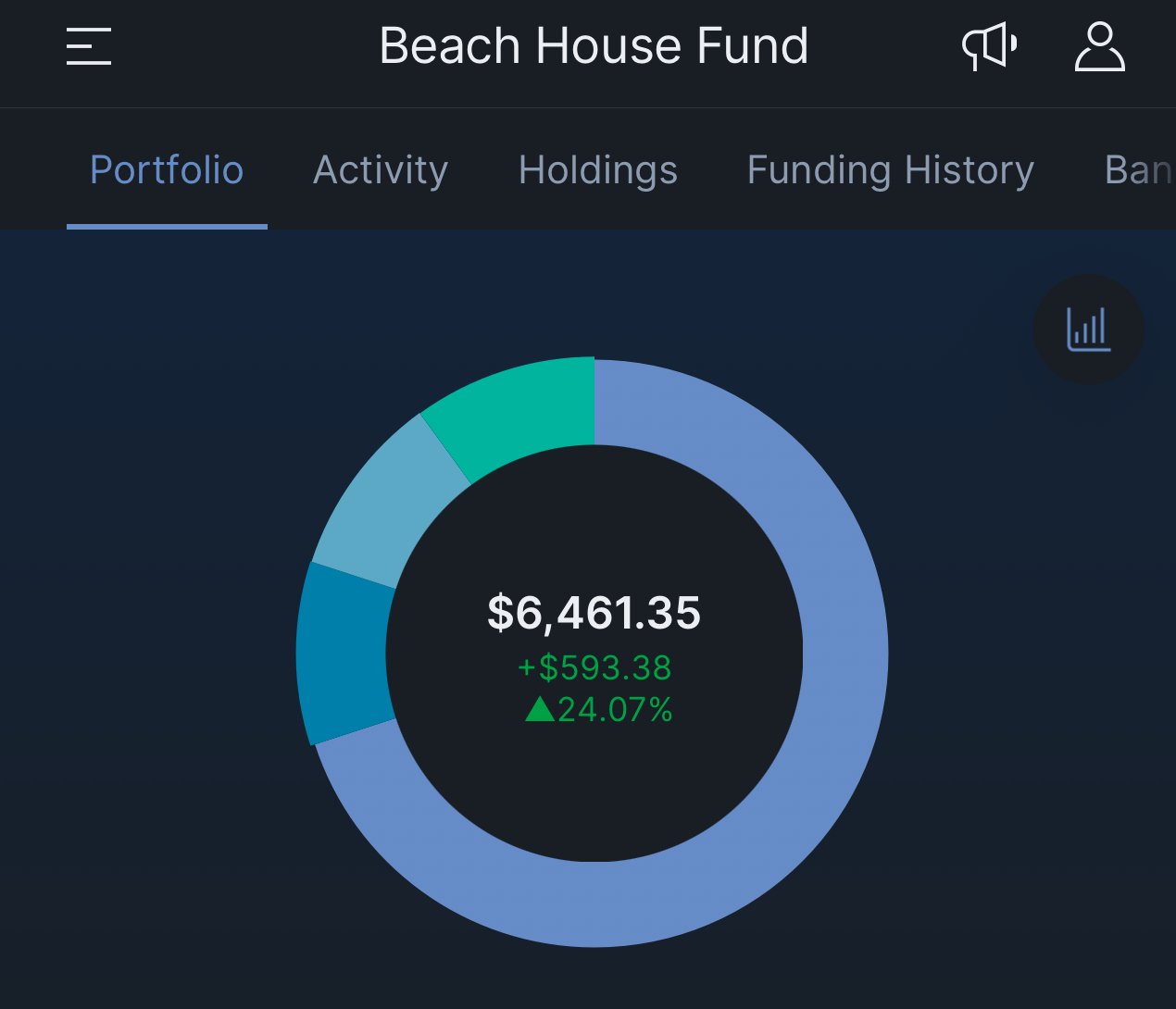

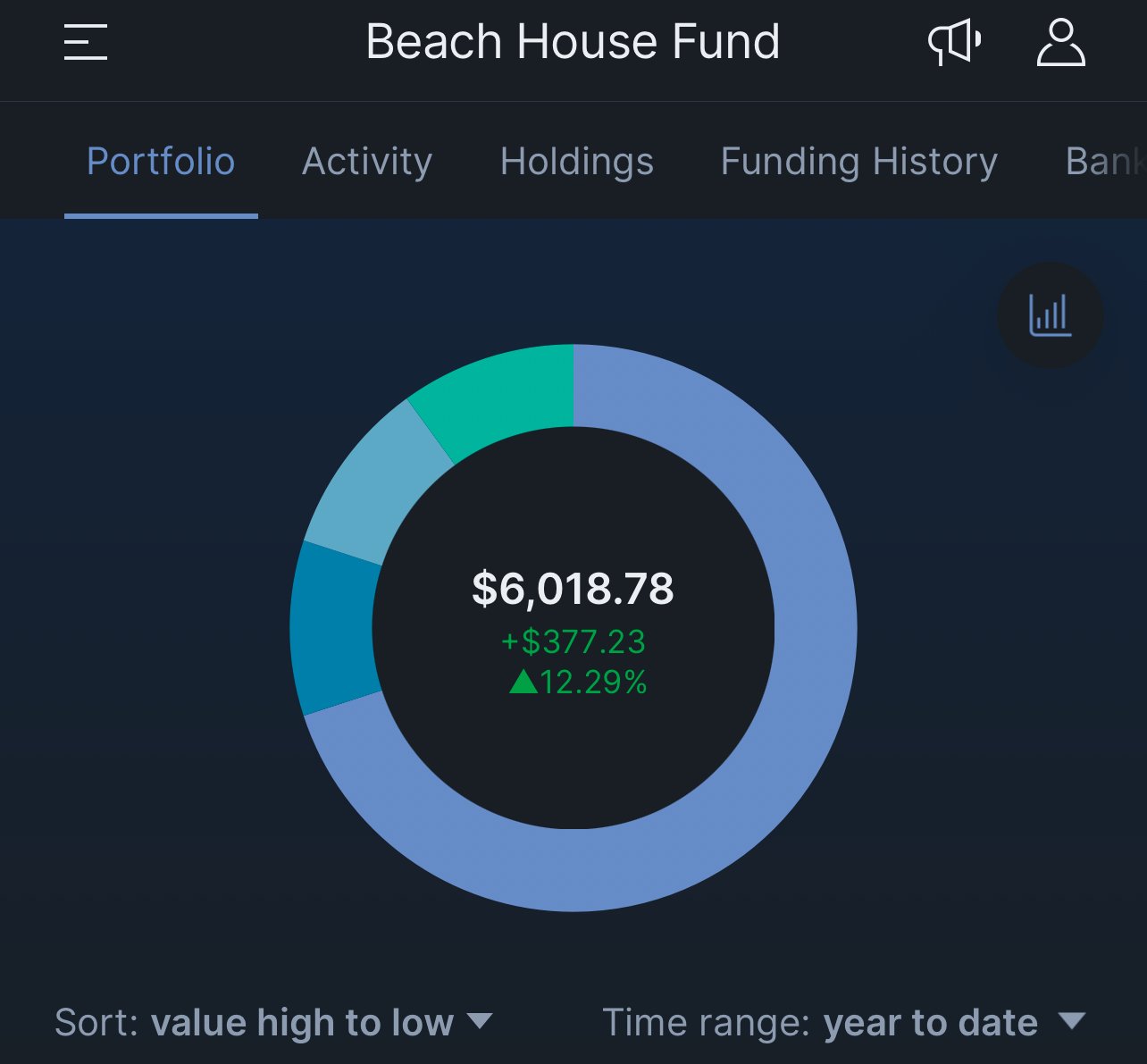

Progress Update

I’m going to keep this section short, my progress has be good, but I’m tracking a bit behind schedule to hit my 5 year goal. Below is a chart tracking my contributions vs investment portfolio total. I’m happy to see that I’m well into the profit territory with $1,238.41 of profits form my investments since starting this project!

For a full update here check out last month’s end of 2024/ Milestone #2 Update Here.

If you want to find out how much you should be contributing every month to reach an investing goal by a given date, check out the Contribution Calculator, I made this tool after I realized I was falling behind on my goal in order to help me get back on track.

Investment Progress over the first 17 Months

The Details

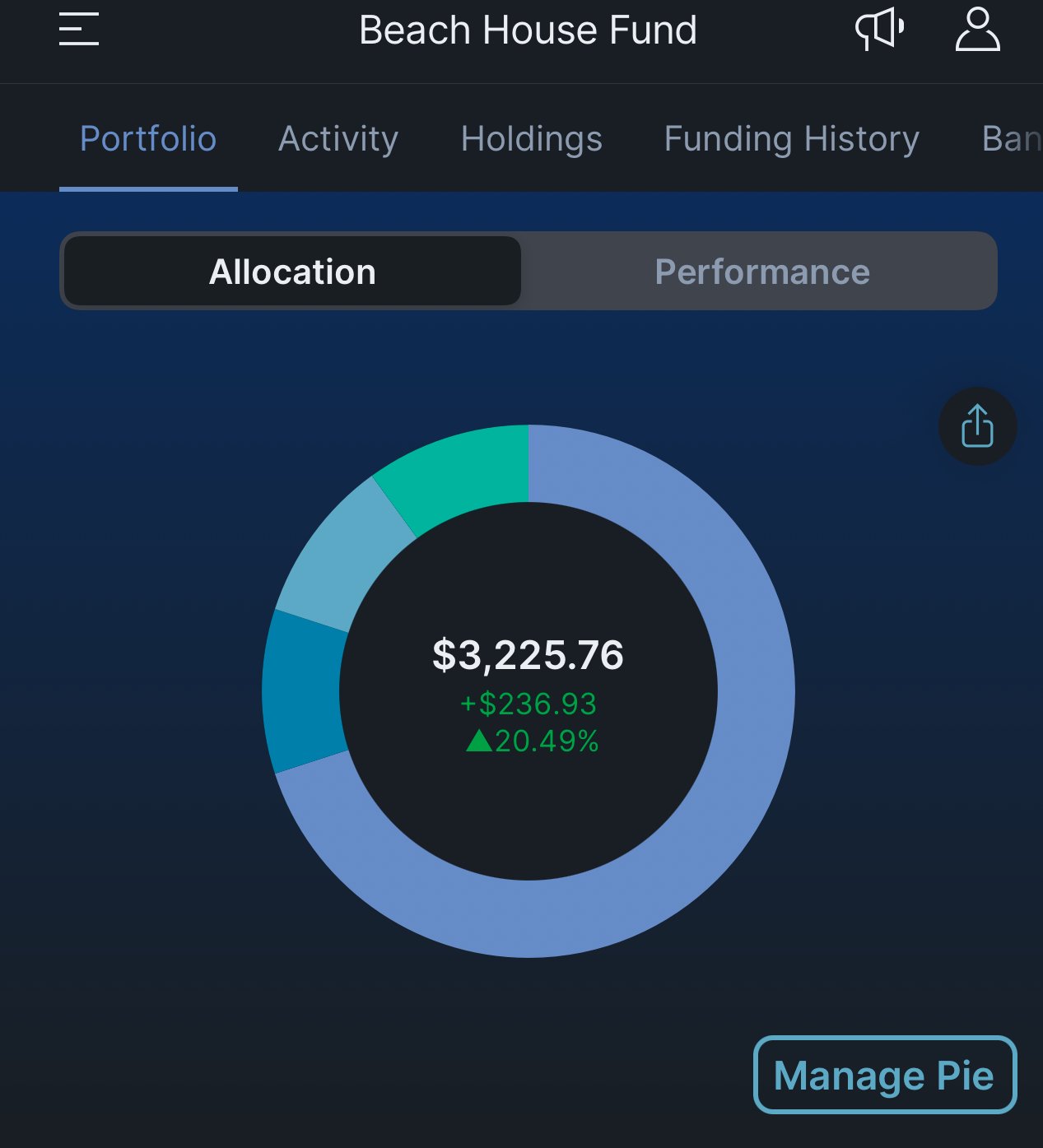

In my original post for this project I outline the strategy behind my allocations, you can use whatever you’re comfortable with. Personally I feel safest with a well diversified index fund based portfolio.

I go over what risks I’m trying to manage in My Simple 3 Fund Strategy article.

I’ve updated my Beach House Fund in response to increased global tensions, a possible bubble in tech stocks, and trying to diversify more into industrials. I outlined my updated strategy in My Simple 4-Fund Strategy post.

I don’t make changes to my allocations very often (this is the first minor change in 16 months) keep in mind I’m not an advisor and am just sharing with you what I’m doing with my beach house fund. your goals and risk tolerance may be different than mine and you should do your own research everyone’s life situation and finances are different.

I’m a slow and steady kind of guy when it comes to investing but I also have healthy emergency fund reserves so I can tolerate some volatility.

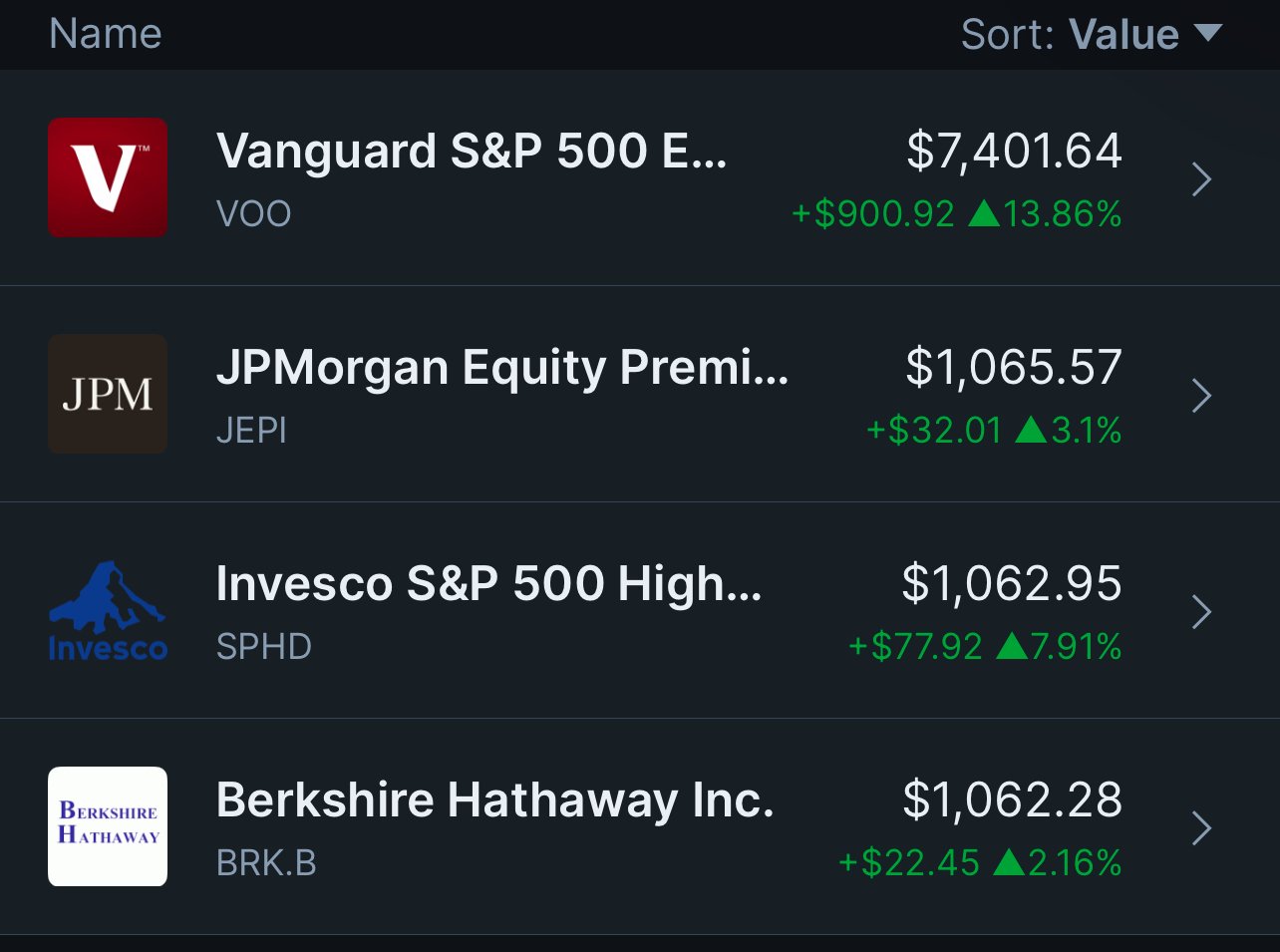

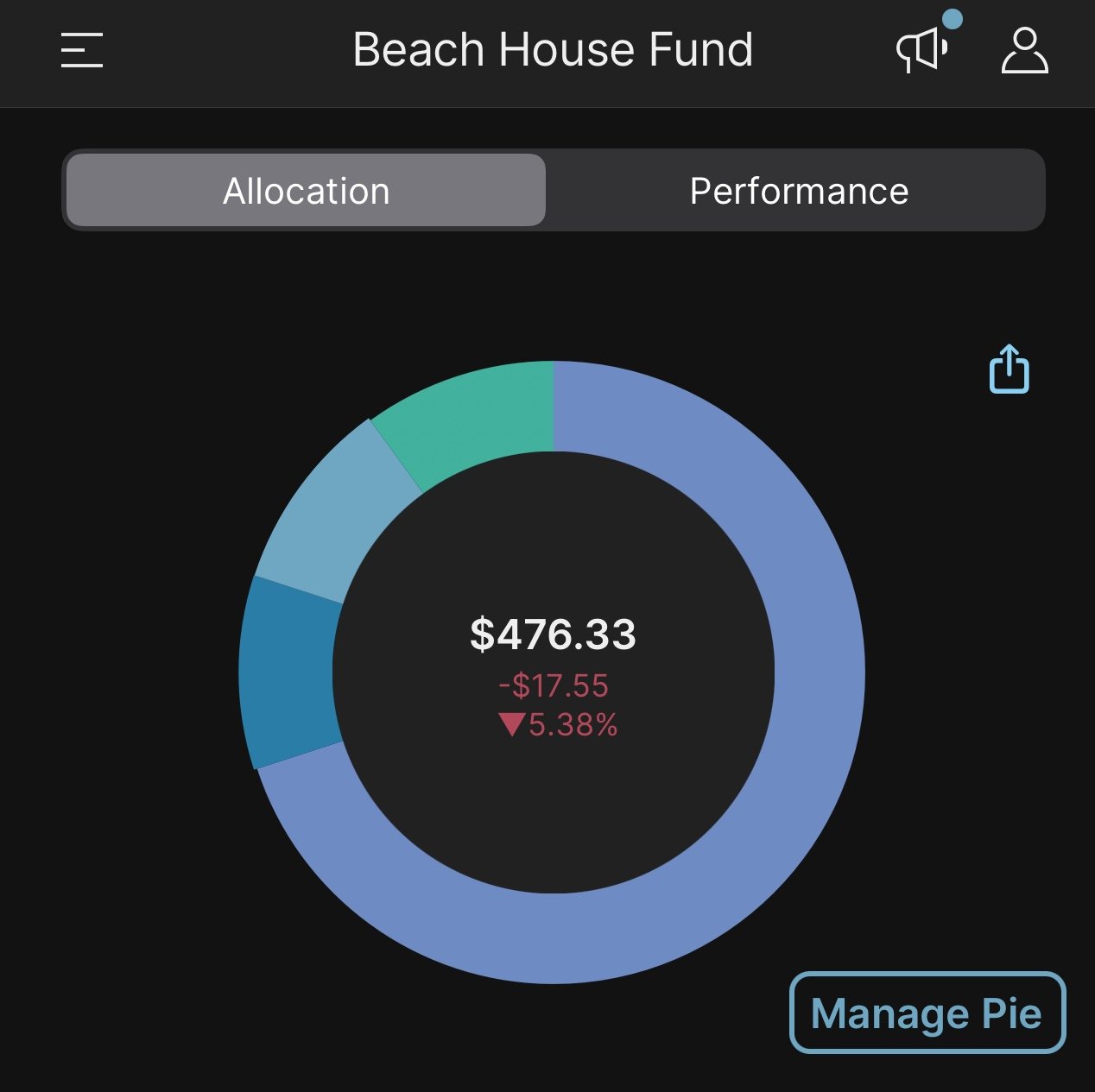

As a quick summary here are my updated target allocations.

70% $VOO SP500 Fund (S&P500 fund)

10% $SPHD (SP500 High Dividend Fund)

10% $JEPI (JPMorgan Equity Premium Dividend Fund)

10% $BRK-B (Berkshire Halthaway)

This was a tough decision for me as many advisors will recommend you have 25-30% of international exposure in your portfolio. I’m bucking this trend for a couple reasons that I outlined in my My Simple 4-Fund Strategy post. I don’t expect a major change in my overall performance, but feel this new allocation strategy will mitigate some of the risks I was concerned about.

Updated Allocations For Beach House Fund (4-Fund Stratagy)

That’s it for this update! We are making great progress but we still need to pick up the pace in 2025, wish me luck!

Subscribe to the newsletter to get the monthly update on the beach house fund, We’ll be hitting $10K soon!