Month 14 Update: Beach House Fund – Journey To The First $100K!

October 2024 Update

Table Of Contents

Introduction

Welcome to the October 2024 update of the Blind Luck Beach House Project!! Where we show you hot to go from $0 to $100K!

They say making your first $100K is the hardest because it requires your to change your money habits and build systems to accumulate wealth. and

Once you’ve done it you’re 1/3 the way to a million because the compounding effect of just getting started is huge!!

For a detailed write up on why the first $100K is so important plus a some handy calculator tools showing you how long it will take check out this months post How Long Will It Take To Make Your First $100K?

My Goals

When I first set out on this goal in September of 2023 I knew it was going to be a multi year process. I also knew the first year would be the toughest as I worked on getting some momentum going on this so I set some specific and measurable goals.

I outlined this process in my S.M.A.R.T. Goals What They Are & How To Use Them post. You can also find a good example of goal setting in my 2024 New Years Goals update where I write down and break down the details for my top 5 goals for 2024. (Which include this The Beach House Fund of course!)

So let’s revisit the Beach House goal, and how we are doing on our journey.

Goals - High Level

Buy a beach house or have enough invested so I can rent a beach house whenever I want anywhere I want without thinking about money.

Specific Goals (The How):

Have $100,000 Invested for a down payment

Within 5 years (by end of 2028)

Monthly Updates for accountability

Show others how to start from $0 and become financially independent

What I want to do is encourage anyone who has $0 to get started, and make a life changing amount of money

In 2024 the main focus is going to be to save $10,000 by the end of the year.

Now you might be scratching your head. $100,000/ 5 years is $20,000/ per year. Why isn’t that my number? well 2 reasons

Well that’s actually a good question.

The math says I should have by the end of 2024 $15,984.50 or roughly $1,384.48 / month moving forward. (This assumes a consistent 8% return.

I did this math in my Milestone #1 Check-In Post you should check it out I have a nifty monthly contribution web calculator you can use for your own planning purposes.

Updated 2024 Goals:

Goal: $10,000 by end of 2024

Stretch Goal: $15,984.50 end of 2024

With only 2 months left in 2024 I’m coming up a bit short, I’m going to push to hit the $10K goal I set and we’ll need to play some catch up in 2025.

Progress Update

In October 2024 I made the following contribution. .

October 2024 Contributions:

$300 Regular Income

$34.54 CC Cash Back

$34.68 X Ads Revenue

October Total: $369.22

Fund Total: $7,892.97

I’m not going to lie, I’m a bit disappointed in my contribution this month. I feel like I’m slowly falling behind on this goal. Life had had a way of getting in the way and I’ve had some bills come up that weren’t planned. but that’s life and we need to adjust as life happens.

The key thing when you are down is to keep making forward progress. if you keep moving you’ll eventually get there, even if it’s not the timeline you originally wanted. I’m ok with this as I’m hitting my other financial goals for the year so overall I’m in a very good position. The beach house fund while a priority for me is still in the discretionary category.

At the end of October we are 2 months away from the end of the year 61 days!! We will need to step it up! 100K to magically happen someday.

I tend to be harder on myself than I should be and I set big goals to force myself to change my behaviors, vs “just hope something happens”.

I need to remind myself I’ve had some successes this year too.

Maxed out ROTH IRA ($7,000)

Continue to grow 3D printing biz

I’ve maxed out my ROTH IRA for the year ($7,000)

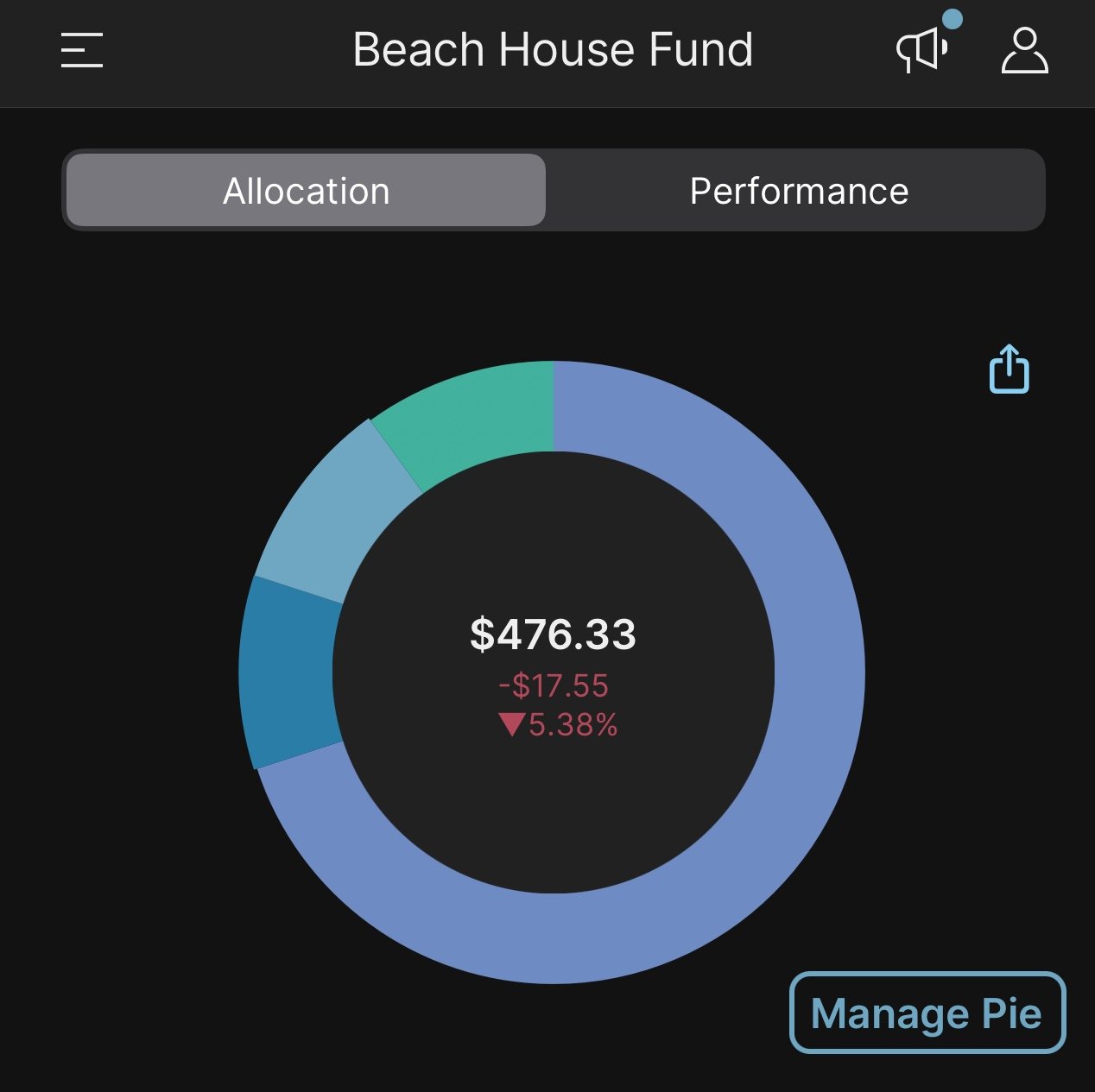

My YOLO fund is also doing well (I might be rolling that fund into this one soon to jump start things)

Oh and most importantly I’m still technically retired from my old 9-5 so LIFE IS GOOD!

This is just one of my goals, and while it’s an important one for me just because I’m a bit behind doesn’t mean I’m in a bad spot.

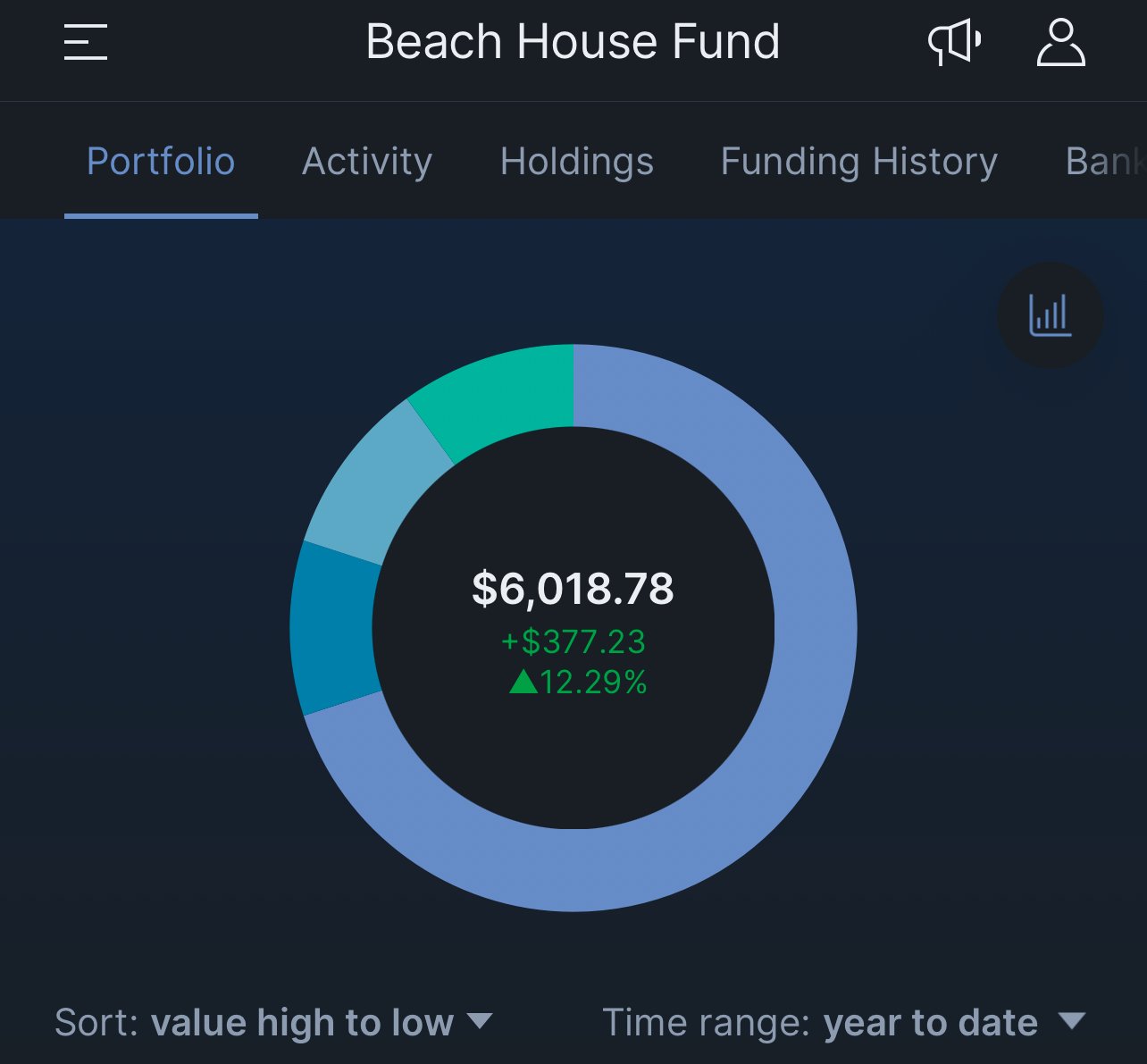

Total progress to date!

The Details

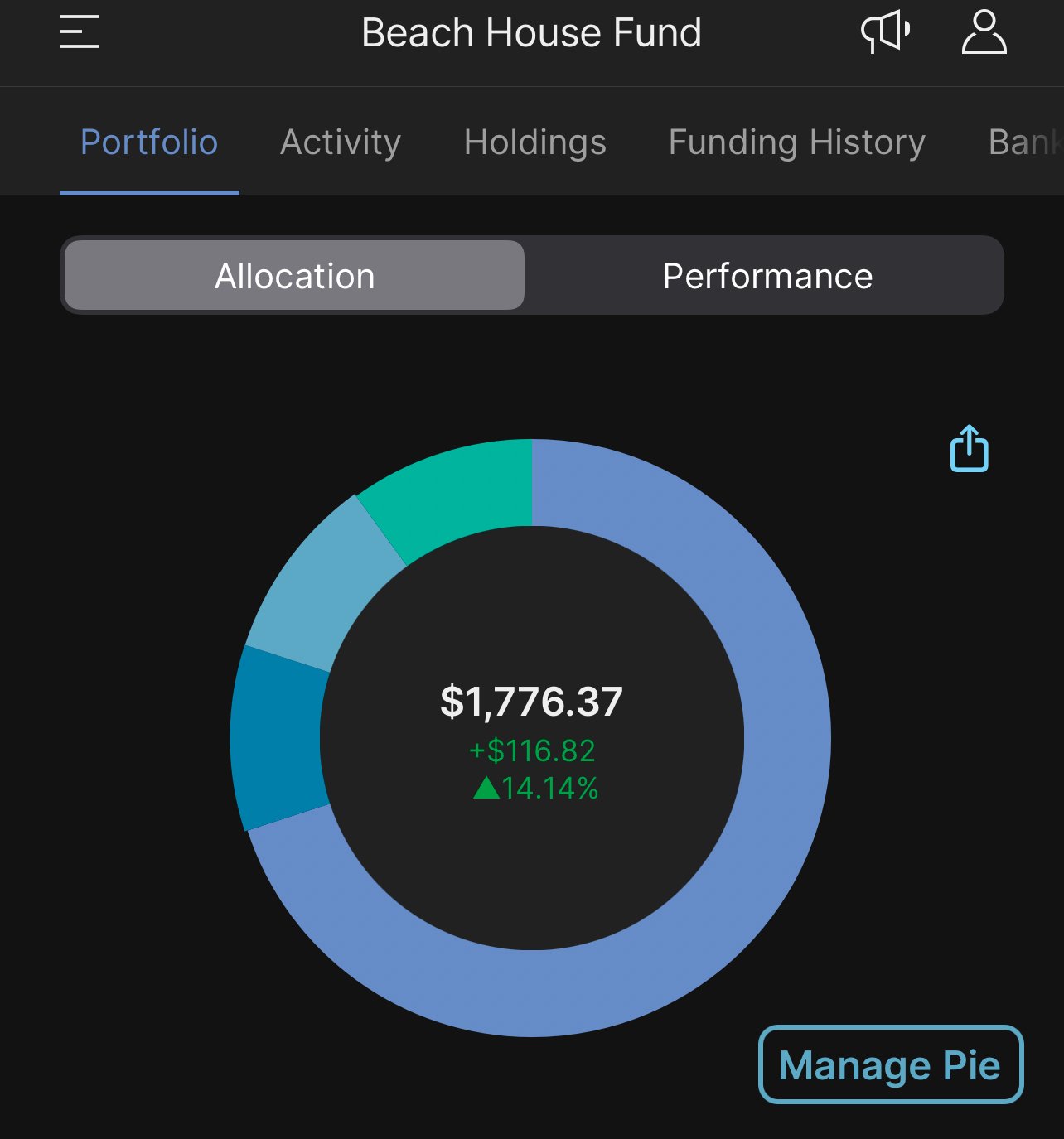

Over all the first 13 months of the Beach House Fund the markets have been quite strong, which have helped us along with our anemic contribution rate.

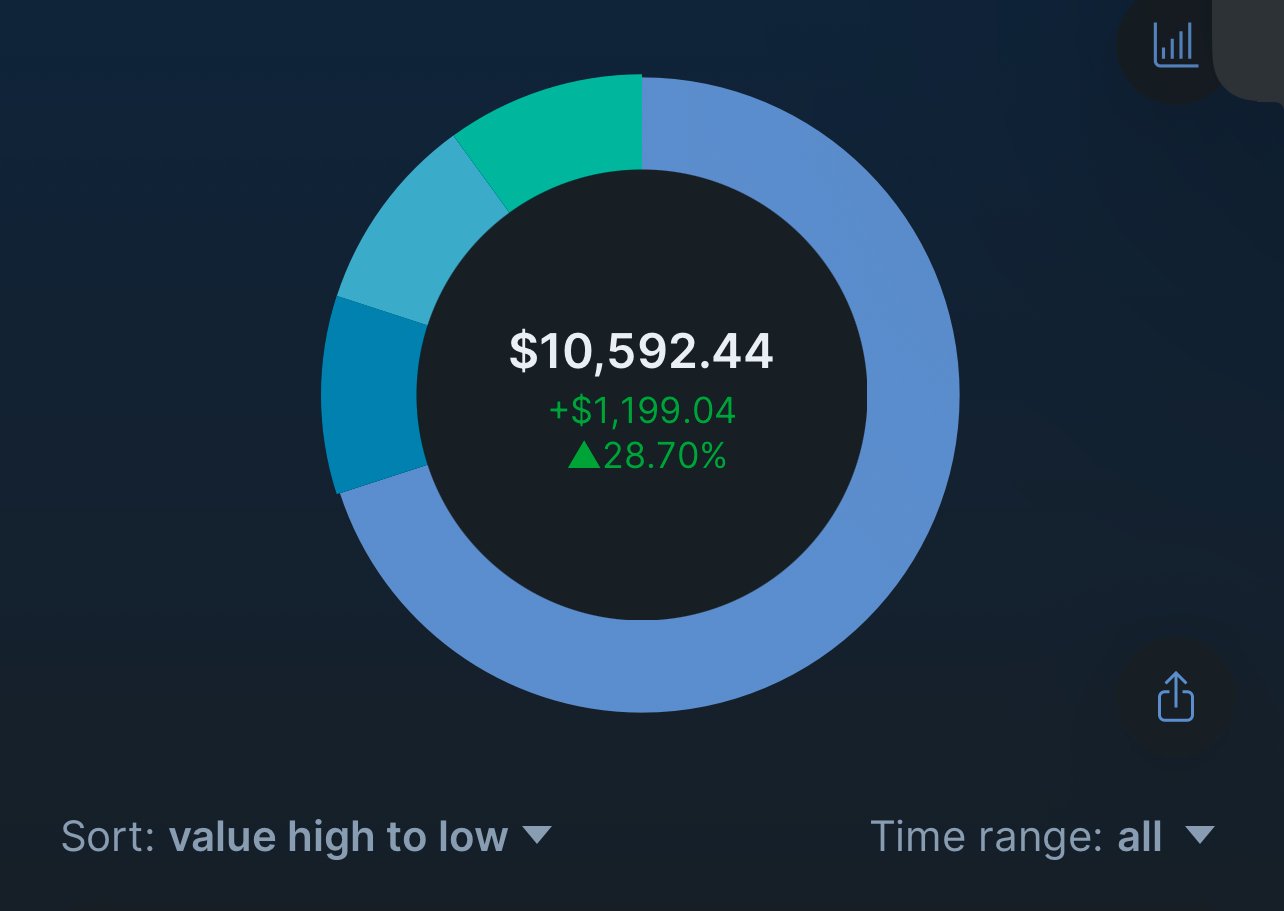

$7,029.88 Total Cash Contributions

$863.09 Market returns (Including Dividends reinvested)

Portfolio Total $7,892.97

Good progress to our $10,000 milestone. Of the current portfolio total around 10.94% of the total has been from market returns. The holdings themselves have done much better than 10.94% but since this is a young account much of the money has been in the account for less than 1 year so the total returns look lower than total market returns. This should change over time as the account starts to do more of the lifting.

Regardless we are in double digit territory and I’m pleased with overall progress of the investment pie.

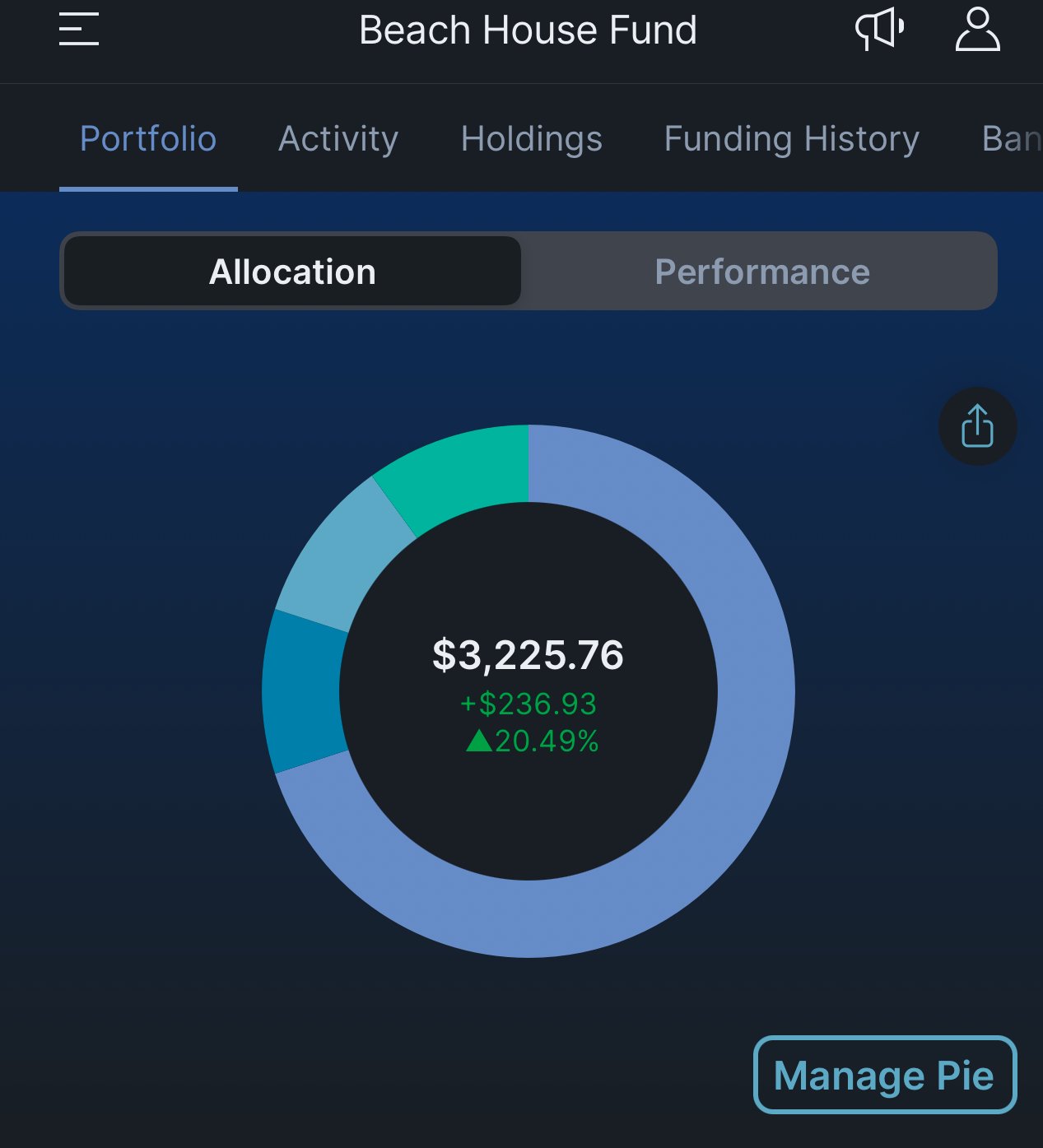

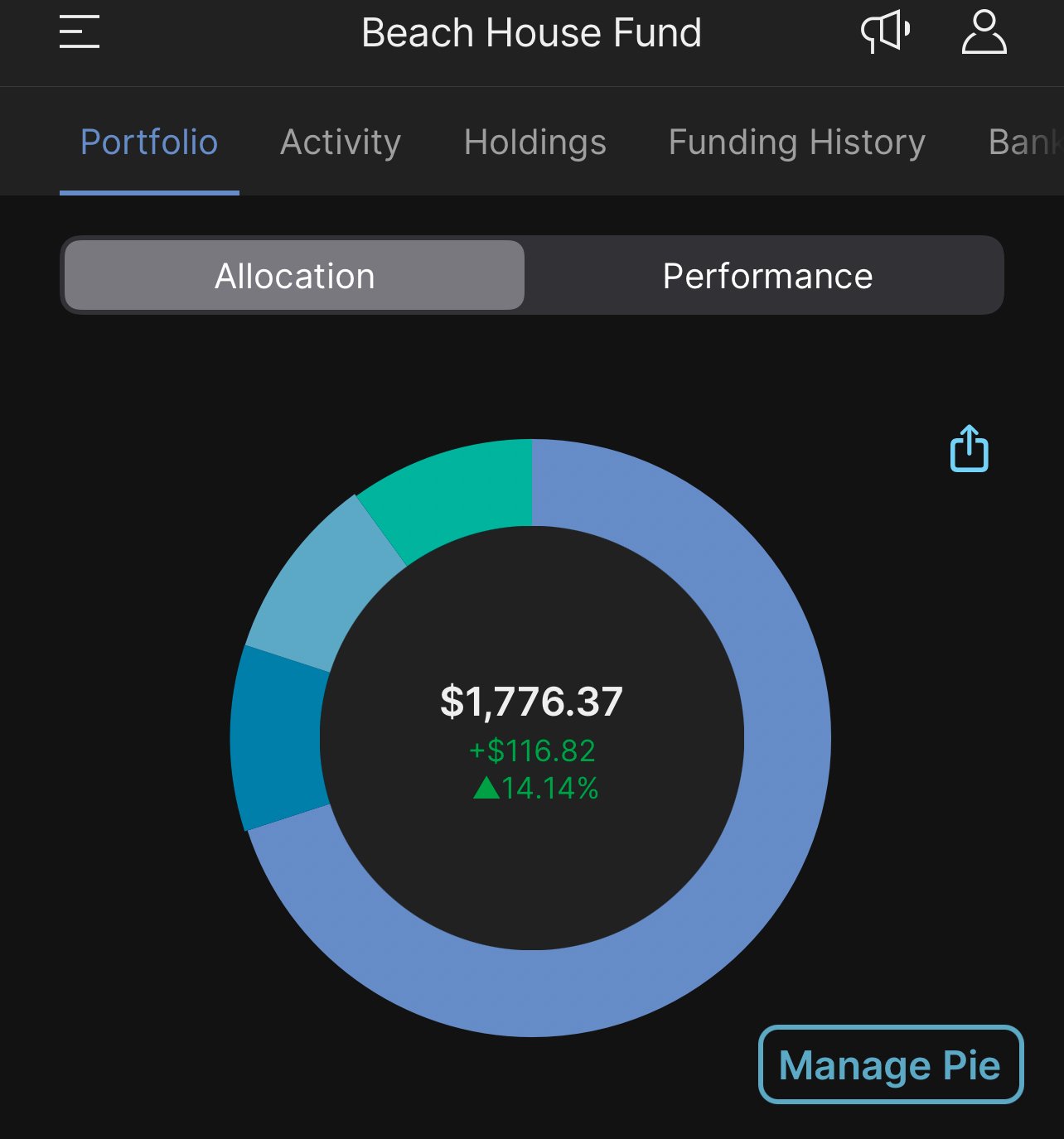

What I’m invested in

Investment Allocations

In my original post for this project I outline the strategy behind my allocations, you can use whatever you’re comfortable with. Personally I feel safest with a well diversified index fund based portfolio. I talk about what risks I’m trying to manage in My Simple 3 Fund Strategy article. Do your own research everyone’s life situation and finances are different. I’m a slow and steady kind of guy when it comes to investing but I also have healthy emergency fund reserves so I can tolerate some volatility.

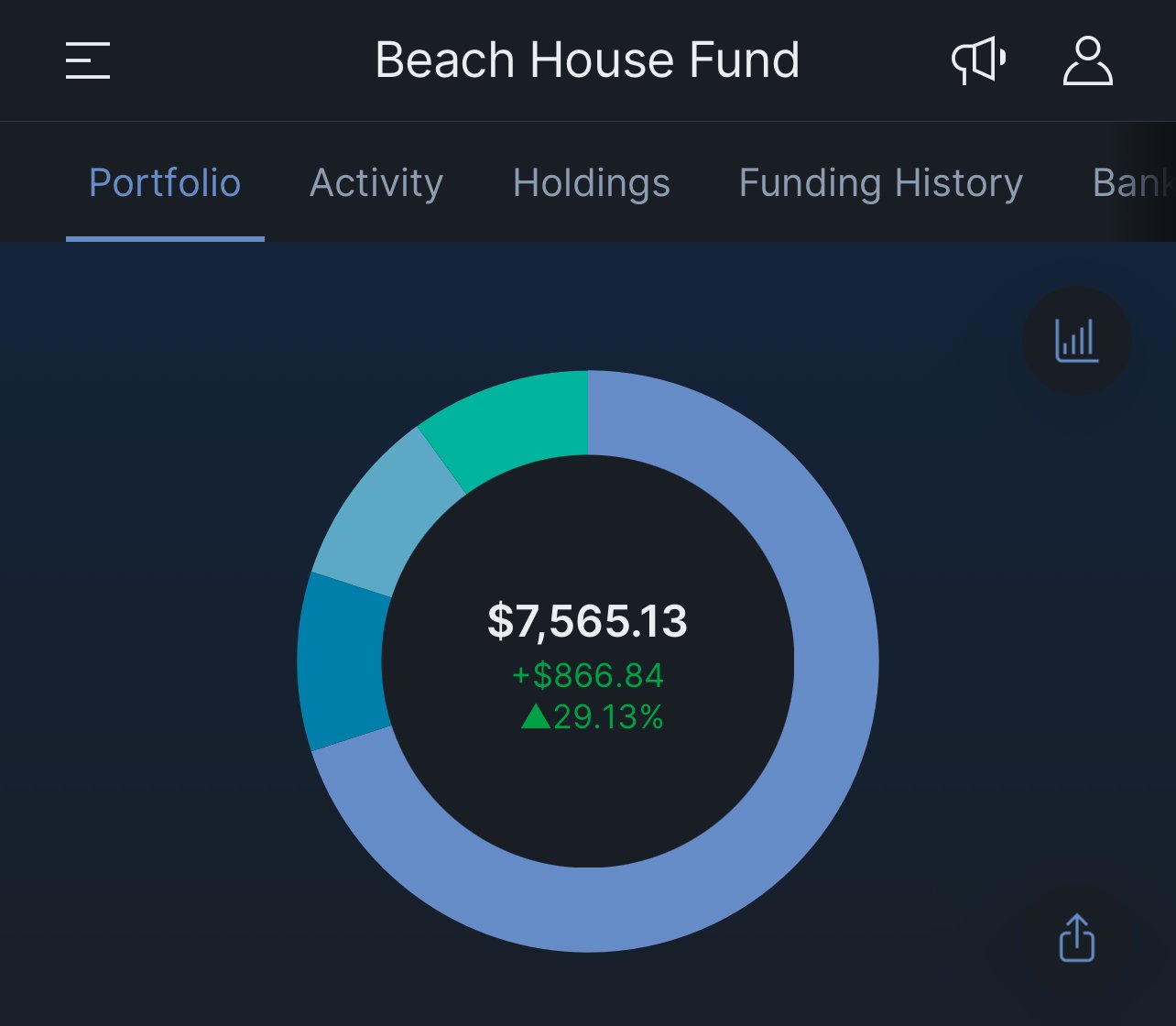

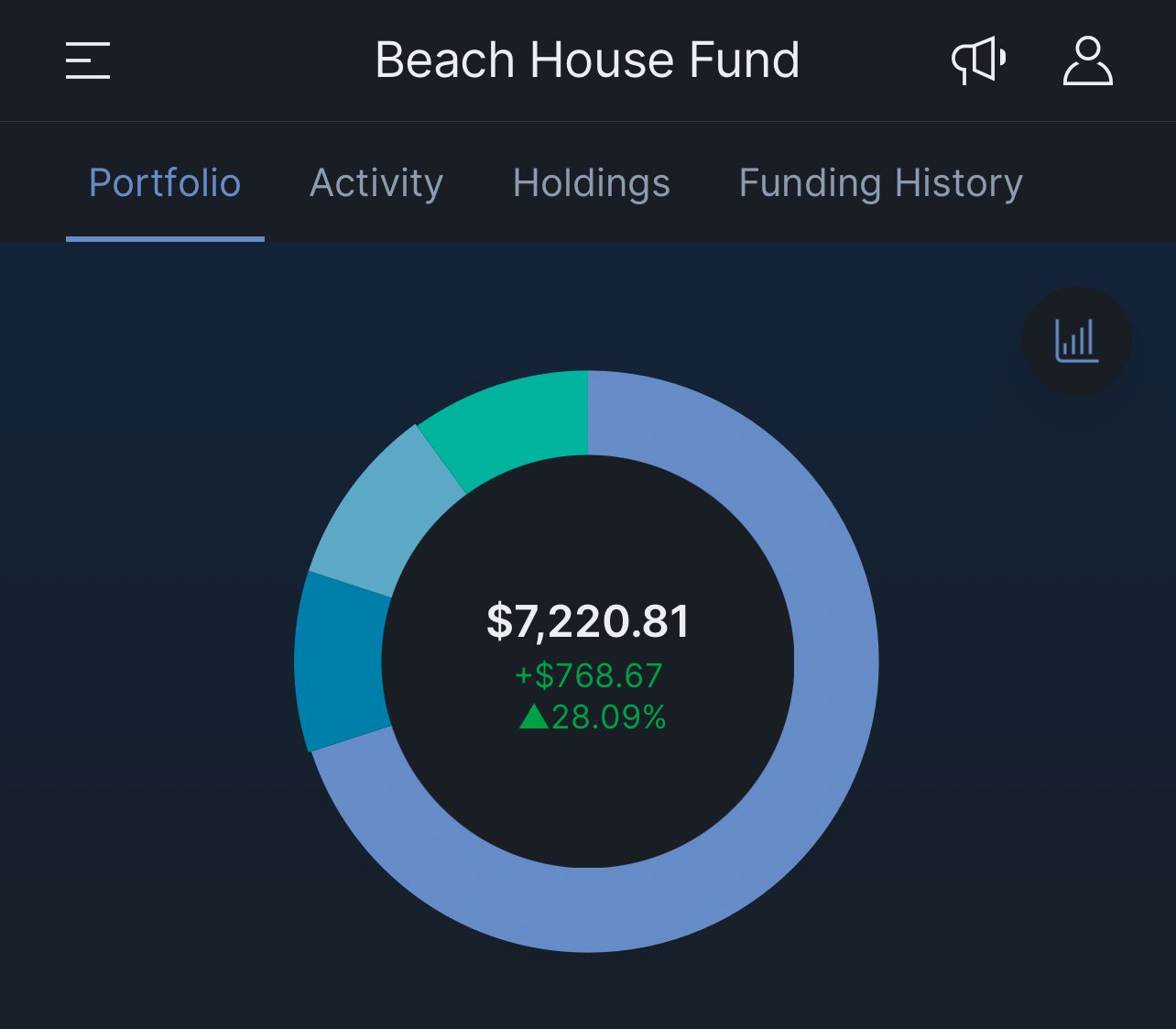

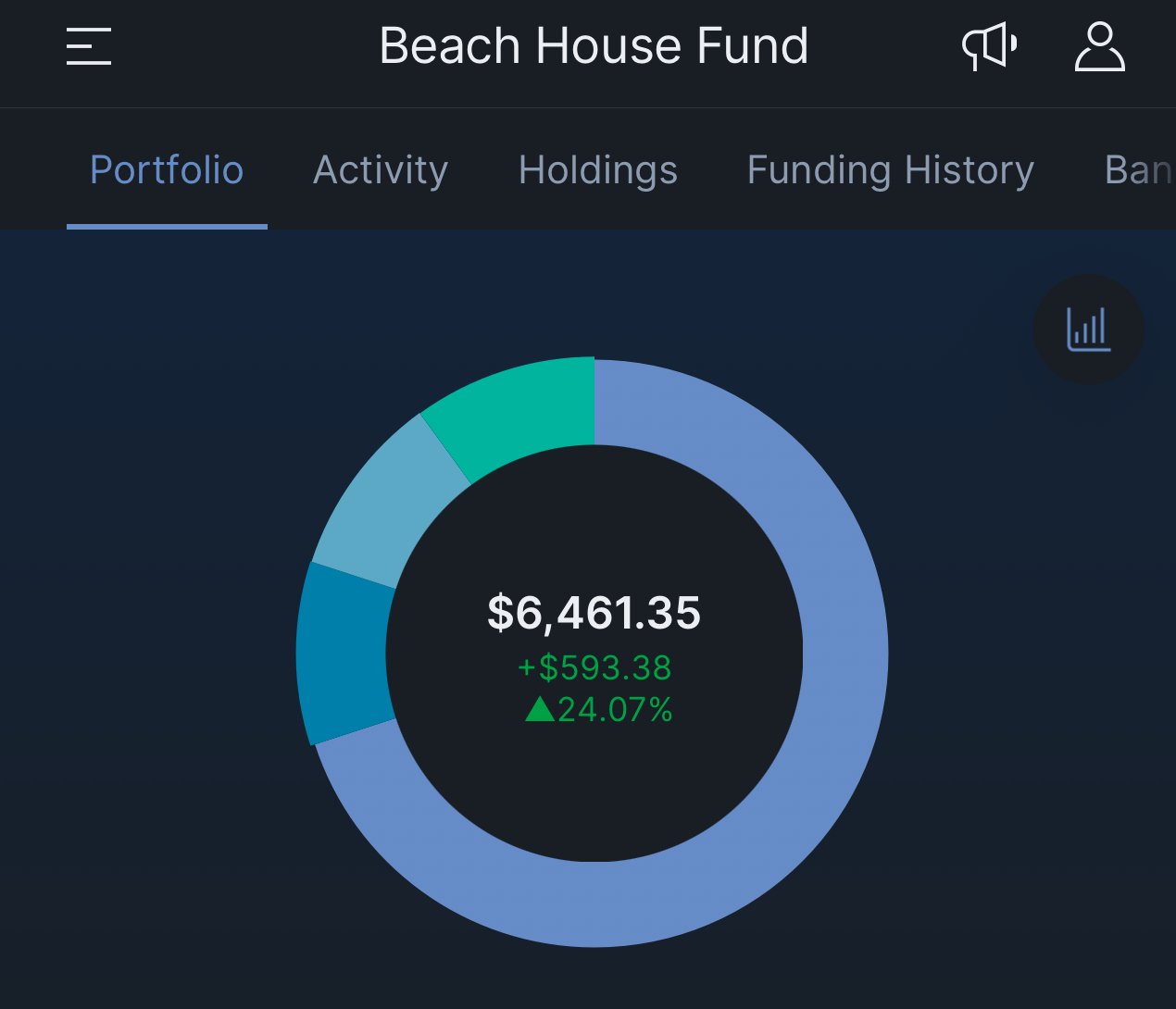

As a quick reminder here are my target allocations.

70% $VOO SP500 Fund (S&P500 fund)

10% $SPHD (SP500 High Dividend Fund)

10% $JEPI (JPMorgan Equity Premium Dividend Fund)

10% $VXUS (Total International Fund)

That’s it for this month! subscribe to the newsletter to get the monthly update on the beach house fund, We’ll be hitting $10K soon!